Tandem Diabetes Care, Inc. (NASDAQ:TNDM) reported better-than-expected fourth-quarter financial results on Thursday.

Tandem Diabetes Care reported quarterly losses of 1 cent per share which beat the analyst consensus estimate of losses of 8 cents per share. The company reported quarterly sales of $290.400 million which beat the analyst consensus estimate of $277.029 million.

Tandem Diabetes Care said it sees FY2026 sales of $1.065 billion to $1.085 billion, versus market estimates of $1.103 billion.

“2025 was a defining year for Tandem as we surpassed $1 billion in worldwide sales and set gross margin records, while modernizing our commercial operations, reshaping our business model, and driving innovation,” said John Sheridan, president and chief executive officer. “In 2026, we plan to build upon this momentum as we further strengthen our business, while delivering new technology solutions to improve the lives of people with diabetes.”

Tandem Diabetes Care shares rose 36% to trade at $25.19 on Friday.

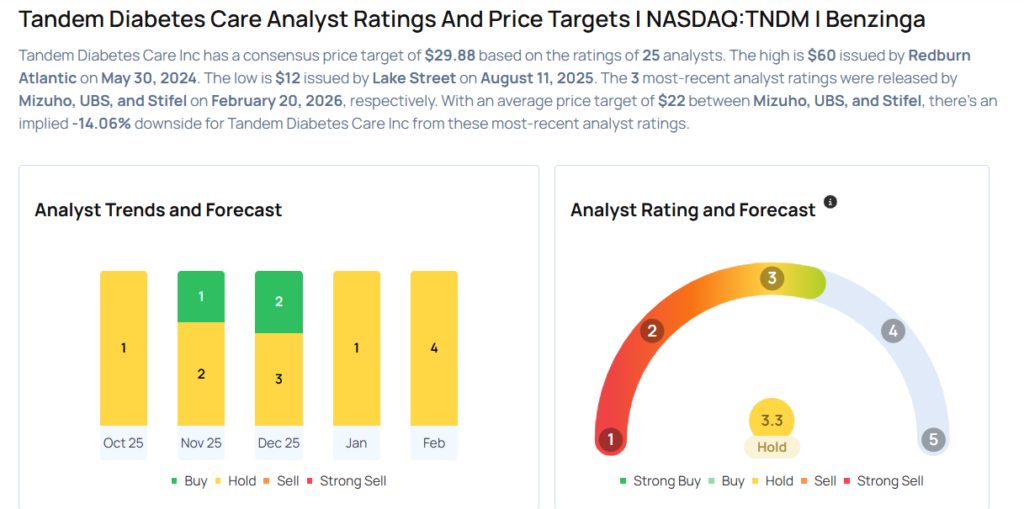

These analysts made changes to their price targets on Tandem Diabetes Care following earnings announcement.

- Piper Sandler analyst Matt O’Brien maintained Tandem Diabetes Care with a Neutral and raised the price target from $14 to $21.

- B of A Securities analyst Travis Steed upgraded the stock from Underperform to Neutral and raised the price target from $15 to $30.

- Stifel analyst Jonathan Block maintained Tandem Diabetes Care with a Hold and raised the price target from $20 to $22.

- UBS analyst Danielle Antalffy maintained the stock with a Neutral and raised the price target from $17 to $22.

- Mizuho analyst Anthony Petrone maintained Tandem Diabetes Care with a Neutral and raised the price target from $21 to $22.

Considering buying TNDM stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments