YETI Holdings, Inc. (NYSE:YETI) reported upbeat fourth-quarter financial results and issued FY26 adjusted EPS guidance with its midpoint below estimates on Thursday.

YETI Holdings reported quarterly earnings of 92 cents per share which beat the analyst consensus estimate of 88 cents per share. The company reported quarterly sales of $583.708 million which beat the analyst consensus estimate of $582.455 million.

YETI Holdings said it sees FY2026 adjusted EPS of $2.77-$2.83, versus market estimates of $2.83. The company sees sales of $1.980 billion-$2.017 billion, versus estimates of $1.975 billion.

Matt Reintjes, President and Chief Executive Officer, commented, “Q4 was our strongest quarter of the year as the YETI brand continued to build momentum. We’re seeing solid demand, our teams are executing with discipline, and the strategy we’ve been building over the last few years is showing through in the numbers and outlook.”

YETI shares rose 0.1% to trade at $47.10 on Friday.

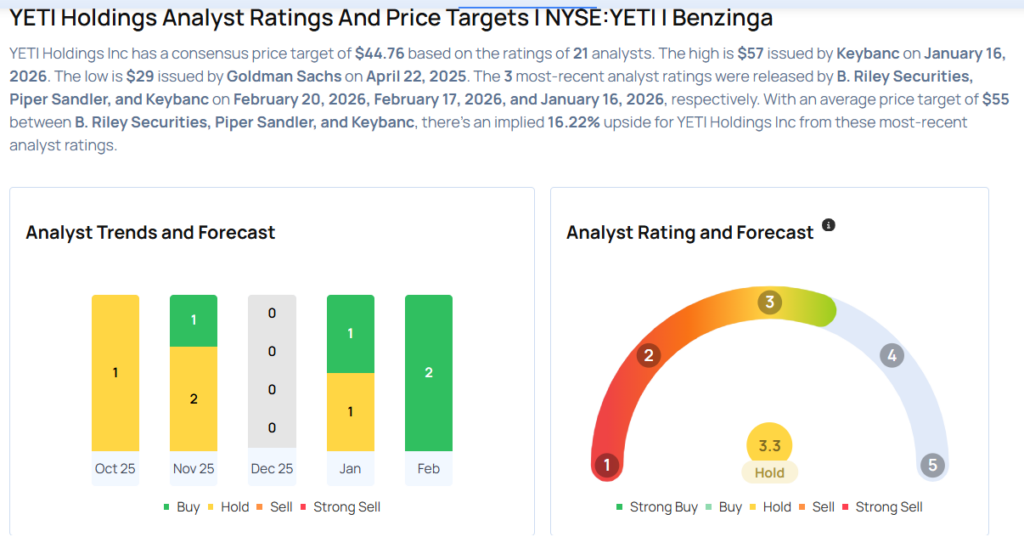

These analysts made changes to their price targets on YETI following earnings announcement.

- B. Riley Securities analyst Anna Glaessgen upgraded YETI Holdings from Neutral to Buy and raised the price target from $35 to $54.

- Baird analyst Peter Benedict maintained the stock with an Outperform rating and raised the price target from $52 to $54.

Considering buying YETI stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments