Deere & Company (NYSE:DE) reported better-than-expected earnings for its first quarter on Thursday.

Deere’s EPS of $2.42 beat the $2.06 analyst estimate. Worldwide net sales and revenues increased 13% to $9.611 billion, beating the $7.686 billion estimate.

“While the global large agriculture industry continues to experience challenges, we’re encouraged by the ongoing recovery in demand within both the construction and small agriculture segments,” said John May, chairman and CEO of John Deere.

Deere raised fiscal 2026 net income guidance to a range of $4.5 billion to $5.0 billion. The company projected Production & Precision Agriculture net sales down 5% to 10%, Small Agriculture & Turf net sales up about 15%, and Construction & Forestry net sales up about 15%, with Financial Services net income of about $840 million.

Deere shares fell 0.7% to trade at $657.34 on Friday.

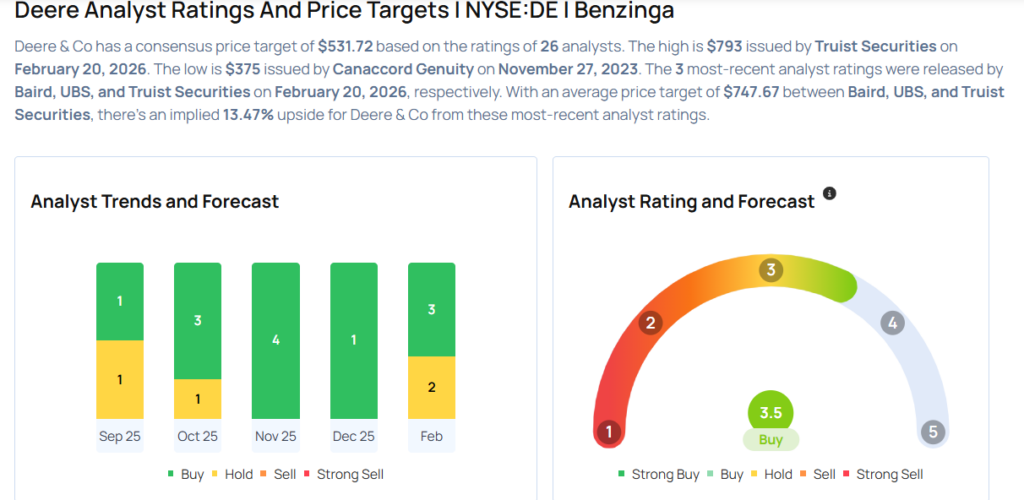

These analysts made changes to their price targets on Deere following earnings announcement.

- B of A Securities analyst Ross Gilardi maintained Deere with a Neutral and raised the price target from $502 to $672.

- RBC Capital analyst Sabahat Khan maintained the stock with an Outperform rating and raised the price target from $541 to $736.

- Truist Securities analyst Jamie Cook maintained Deere with a Buy and raised the price target from $612 to $793.

- UBS analyst Steven Fisher maintained the stock with a Buy and raised the price target from $535 to $775.

- Baird analyst Mircea Dobre maintained the stock with a Neutral and raised the price target from $467 to $675.

Considering buying DE stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments