Wayfair Inc. (NYSE:W) reported upbeat fiscal fourth-quarter 2025 earnings on Thursday.

The company reported fourth-quarter adjusted earnings per share of 85 cents, beating the analyst consensus estimate of 66 cents. Quarterly sales of $3.337 billion (+6.9% year over year) outpaced the Street view of $3.301 billion.

Active customers totaled 21.3 million as of December 31, 2025, a decrease of 0.5% year over year.

“We had our third consecutive quarter of new customer growth, on top of healthy growth in repeat orders, all in the face of a category that contracted in the low single digits for the final quarter of the year,” said Niraj Shah, CEO, co-founder, and co-chairman, Wayfair.

Wayfair expects mid-single-digit year-over-year revenue growth in the first quarter of 2026, with gross margins projected in the 30%–31% range, likely toward the low end. Adjusted EBITDA is anticipated to come in between 4.5% and 5.5% of net revenue.

Wayfair shares gained 2.1% to trade at $81.26 on Friday.

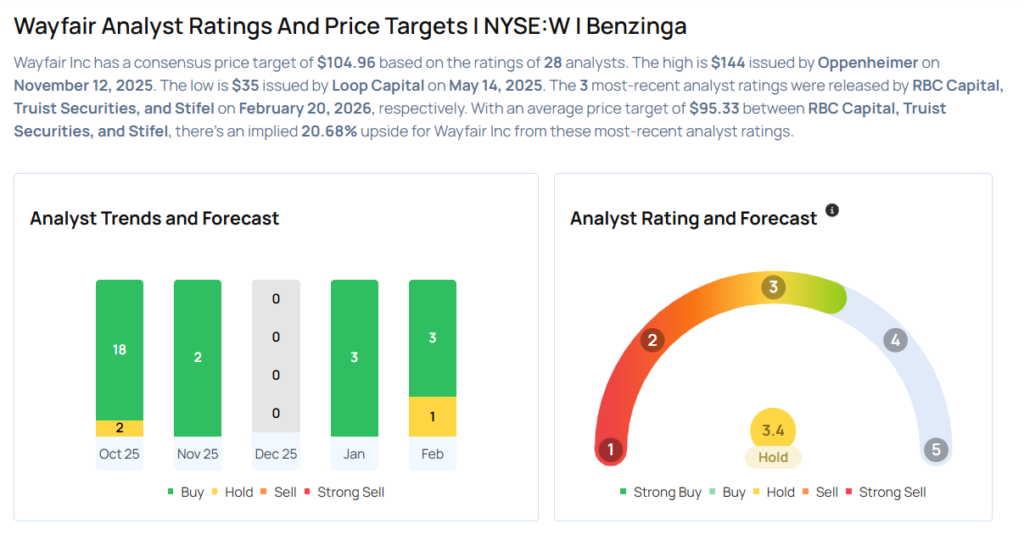

These analysts made changes to their price targets on Wayfair following earnings announcement.

- Wedbush analyst Scott Devitt maintained Wayfair with a Neutral and lowered the price target from $100 to $85.

- Evercore ISI Group analyst Oliver Wintermantel maintained the stock with an Outperform rating and lowered the price target from $115 to $100.

- Stifel analyst Mark Kelley maintained Wayfair with a Hold and lowered the price target from $100 to $89.

- Truist Securities analyst Youssef Squali maintained the stock with a Buy and lowered the price target from $120 to $105.

- RBC Capital analyst Steven Shemesh maintained Wayfair with a Sector Perform and raised the price target from $86 to $92.

Considering buying W stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments