Sensata Technologies Holding plc (NYSE:ST) reported better-than-expected earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of 88 cents per share which beat the analyst consensus estimate of 86 cents per share. The company reported quarterly sales of $917.900 million which beat the analyst consensus estimate of $910.199 million.

Sensata Technologies said it sees first-quarter adjusted EPS of 81 cents to 85 cents versus market estimates of 83 cents. The company sees sales of $917.000 million to $937.000 million, versus estimates of $924.999 million.

“With our Q4 and Full Year 2025 results, I am pleased to report that we delivered on our objectives for the first year of our transformation journey. We expanded margins sequentially each quarter this year, dramatically improved free cash flow, strengthened our balance sheet, and, in the fourth quarter, we returned to year-over-year revenue growth,” said Stephan von Schuckmann, Sensata’s Chief Executive Officer. “As we look ahead to 2026 and beyond, we are now a more resilient organization, and we have a solid foundation on which to build. I am confident that with our strengthened leadership team and renewed focus, we will build upon this momentum to unlock growth in each of our segments over time.”

Sensata shares gained 2.8% to trade at $37.16 on Friday.

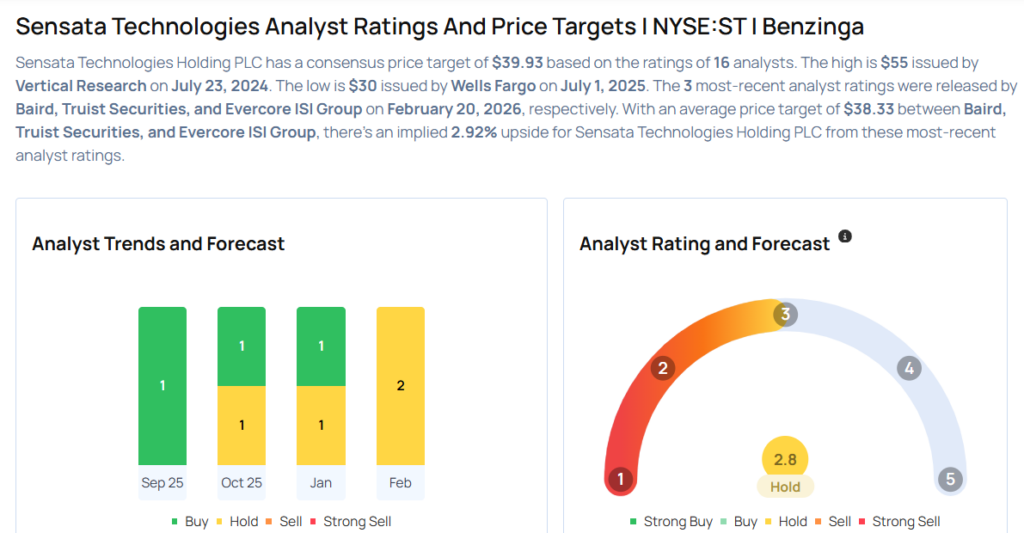

These analysts made changes to their price targets on Sensata following earnings announcement.

- B of A Securities analyst Wamsi Mohan maintained Sensata with a Neutral and raised the price target from $37 to $40.

- Evercore ISI Group analyst Amit Daryanani maintained the stock with an In-Line rating and raised the price target from $32 to $37.

- Truist Securities analyst William Stein maintained the stock with a Hold and raised the price target from $35 to $38.

- Baird analyst Luke Junk maintained Sensata with a Neutral and raised the price target from $39 to $40.

Considering buying ST stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments