As of Feb. 20, 2026, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Daktronics Inc (NASDAQ:DAKT)

- On Dec. 23, Daktronics announced the acquisition of the intellectual property (IP), equipment assets and technical expertise from X Display Company Technology Limited (XDC). “We believe this move further strengthens our competitive position and will allow us to provide current and future customers globally with the next generation of display technology,” said Daktronics Interim President & CEO Brad Wiemann. “It also gives us an experienced team of engineers in the field of MicroLED and MicroIC technologies that we believe reinforces our commitment to technical excellence and innovation.” The company’s stock gained around 29% over the past month and has a 52-week high of $28.22.

- RSI Value: 79.1

- DAKT Price Action: Shares of Daktronics fell 0.6% to close at $27.33 on Thursday.

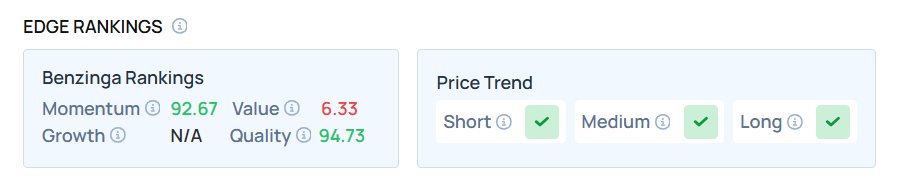

- Edge Stock Ratings: 92.67 Momentum score with Value at 6.33.

Fastly Inc (NASDAQ:FSLY)

- On Feb. 11, Fastly reported better-than-expected fourth-quarter financial results and issued FY26 and first-quarter guidance above estimates. “Our fourth quarter results mark an inflection in Fastly’s growth as we achieved record revenue, gross margin, and operating profit,” said Kip Compton, CEO of Fastly. “In 2025 we made significant progress on Fastly’s transformation and delivered great results. As we look toward 2026, we anticipate continued momentum, with AI as an increasing tailwind for our business.” The company’s stock gained around 106% over the past month and has a 52-week high of $20.27.

- RSI Value: 77.2

- FSLY Price Action: Shares of Fastly fell 4% to close at $18.07 on Thursday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Recent Comments