Advanced Micro Devices (NASDAQ:AMD) has reportedly agreed to guarantee a $300 million loan for cloud computing startup Crusoe.

AMD has proposed a deal to buy back its chips from Crusoe if the startup is unable to attract customers like AI developers. The arrangement, backed by a loan from Goldman Sachs (NYSE:GS), will be collateralized with the chips and associated equipment, The Information reported on Thursday.

With AMD acting as a backstop, Crusoe has locked in a loan interest rate of around 6%, substantially below what it would have otherwise achieved. The company is now installing AMD chips in an Ohio data center being built by 5C, a Canadian developer supported by Brookfield.

Crusoe, launched in 2018 as a cryptocurrency company, has pivoted to AI infrastructure and is part of the emerging “neoclouds” offering specialized cloud and data-center services for AI companies.

AMD and Crusoe did not immediately respond to Benzinga‘s request for comment.

AMD Steps Up To Challenge Nvidia

This move by AMD follows a trend in the tech industry. NVIDIA Corp.’s (NASDAQ:NVDA) investment in OpenAI sparked concerns about a “circular” investment loop, where startups invested in by Nvidia would purchase the company’s chips. Some of the other start-ups where Nvidia invested are Anthropic, Together AI, Lambda, and CoreWeave (NASDAQ:CRWV), now a listed company.

AMD has been making strategic moves to compete with Nvidia. Earlier this week, AMD expanded its work with India’s Tata Consultancy Services to roll out its newest AI data center design, aiming to take share from Nvidia in a rapidly scaling market.

In Q4, AMD posted a record $10.3 billion in revenue, up 34% year-over-year, driven by its Data Center segment, which hit $5.4 billion. Management expects this segment to grow over 60% annually over the next three to five years.

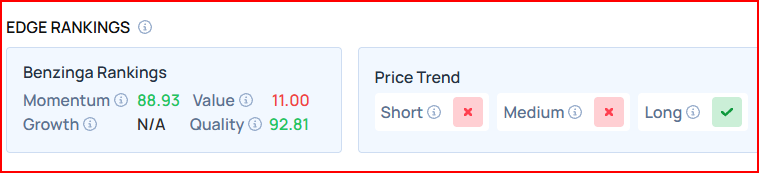

According to Benzinga Edge Stock Rankings, AMD has a momentum score of 88.93% and a quality rating of 92.81%. Benzinga’s screener allows you to compare AMD’s performance with its peers.

NFLX Price Action: AMD shares declined 8.99% on a year-to-date basis, according to Benzinga Pro data. On Thursday, it closed 1.62% higher at $203.37.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments