Meta Platforms Inc. (NASDAQ:META) has reduced annual stock awards for the majority of its workforce by approximately 5%, marking the second consecutive year of equity cuts as the company reallocates billions toward Artificial Intelligence.

Funding The AI Arms Race

The move of slashing stock awards comes as CEO Mark Zuckerberg prepares for a massive infrastructure expansion, with 2026 capital expenditure projected to reach a record-high range of $115 billion to $135 billion.

The reduction in employee compensation, first reported by the Financial Times, follows a more substantial 10% cut to stock grants last year. The savings are being funneled directly into “Meta Superintelligence Labs,” a core initiative aimed at developing AI that can outperform human capabilities.

“This is going to be a big year for delivering personal superintelligence,” Zuckerberg told investors during the fourth-quarter earnings call. He emphasized that Meta would “continue to invest very significantly in infrastructure to train leading models.”

Gigawatt-Scale Ambitions

Meta’s $135 billion spending goal—a figure that rivals the entire annual budget of New York State—is primarily driven by the construction of gigawatt-scale data centers.

These massive facilities, described by Zuckerberg as having the “energy footprint of a small city,” are essential for the computational power required by next-generation AI.

One such project is a $50 billion data center in rural Louisiana, which President Donald Trump recently highlighted as “the biggest AI data center in the world.” To manage these high-stakes partnerships, Meta recently appointed former Trump advisor Dina Powell McCormick as President and Vice Chairman.

Shifting From Metaverse To Wearables

The pivot to AI has also led to internal restructuring. Meta recently laid off 10% of its Reality Labs division, which has incurred over $70 billion in losses since 2021.

The company is reportedly shifting resources away from pure virtual reality toward AI-powered wearables and “personal superintelligence” products.

While the equity cuts have reportedly “shocked” some staff, Meta leadership remains committed to the aggressive spend. With industry-wide AI capex projected to hit $630 billion this year, Zuckerberg’s strategy signals that at Meta, hardware and infrastructure now take financial precedence over traditional employee incentives.

Meta Declines In 2026

Shares of META have declined by 0.87% year-to-date, while the Nasdaq 100 index was down by 1.62% in the same period. The stock was 14.20% lower over the last six months and 8.38% over the year.

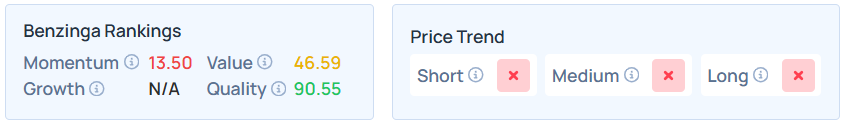

META maintains a weaker price trend over the long, short, and medium terms, with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: gguy on Shutterstock.com

Recent Comments