The release of the Epstein files has sparked a political crisis in Europe, toppling careers in London, Oslo and Paris and triggering market turmoil as governments scramble to contain the fallout.

In the latest development, Andrew Mountbatten-Windsor, the brother of the UK’s King Charles, has been arrested on suspicion of misconduct in public office after further details of his relationship with convicted sex offender Jeffrey Epstein emerged, Bloomberg reported today. Mountbatten-Windsor has not been charged, Bloomberg reported, citing Thames Valley Police.

His arrest comes only weeks after Lord Peter Mandelson, a once-respected British political insider, quit the Labour Party on February 2 and the House of Lords a day later, when the Epstein files revealed payments and leaked secrets he gave to Jeffrey Epstein. Prime Minister Keir Starmer appointed Mandelson as US ambassador in September 2025 despite his known links to a US sex offender.

Other European countries have felt the fallout. Norwegian police charged former PM Thorbjørn Jagland on February 13 with “gross corruption” over his ties to Epstein. France’s Jack Lang, a former French culture minister, resigned from the Arab World Institute because of his relationship with Epstein and an ensuing investigation.

The involvement of several of Europe’s most senior political figures with Epstein comes at a moment of economic strain. The Eurozone posted only 1.3% year‑on‑year growth in the fourth quarter, while industrial production fell 1.4% month‑on‑month in December. These weak indicators, combined with mounting frustration over mass immigration, risk strengthening support for right‑leaning political parties.

The connections that some European elites have with Epstein are “very humiliating,” ex-White House lawyer Richard Painter told NPR. These political tremors quickly spilled into financial markets.

Debt Markets Punish the UK on Epstein Turmoil

Traders turned cautious on UK debt amid the furor from the Epstein‑related scandal. The gap between two‑year and 10‑year gilt yields widened to 86 basis points on February 6, the largest spread since 2018.

Three days later, the 10‑year gilt yield rose to 4.569%, up 5 basis points on the day. The jump in long‑term gilt yields will raise the government’s future borrowing costs, as investors demand a higher premium to hold its debt.

Gilts could become “subject to the whims of random political headlines,” Jordan Rochester, Mizuho EMEA’s Head of Fixed Income, Currencies & Commodities (FICC) Strategy, said in a February 9 interview.

Amid the political turmoil, the FTSE 100 dipped into the red intraday on February 8, then rebounded 0.2% to 10,386.23—near a record high and is up 4.4% year-to-date.

Ten-year gilts fell below 4.5% on Monday as Starmer secured cabinet support and political risks receded.

McSweeney, Allan Departures Spark Succession Talk

The US Justice Department dropped 3 million pages of files related to the Epstein sex scandal on January 29. In the UK, the fallout started a day later when the documents showed that Mandelson had leaked market-sensitive government information to Epstein in 2009 and received $75,000 in payments.

Mandelson forwarded confidential 2009-2010 memos to Epstein about €500 billion in European Union (EU) bailouts, asset sales, and tax changes. In March 2010, he shared details of meetings between former UK Chancellor Alistair Darling and Larry Summers, who was President Barack Obama’s Director of the National Economic Council at the time.

Metropolitan Police launched a criminal investigation into Mandelson on February 3. Police searched two London properties linked to Mandelson as part of the probe.

Starmer has suffered politically for appointing Mandelson despite his documented links to Epstein. In the span of 72 hours this month, his Chief of Staff, Morgan McSweeney, resigned. A day later, his Communications Director, Tim Allan, stepped down. Both were casualties of the Epstein scandal.

Mandelson “lied repeatedly” about his Epstein ties, Starmer told Parliament. “I’ve agreed with His Majesty the King that Mandelson should be removed from the list of privy counselors on the grounds that he’s brought [disgrace].”

Stagnant Economy Leaves No Room for Crisis

The political crisis has collided with a fragile British economy, amplifying investor anxiety and deepening public discontent with Starmer’s leadership.

The British economy expanded just 0.1% in the fourth quarter, according to data from the Office for National Statistics on February 12. That was below the 0.2% consensus.

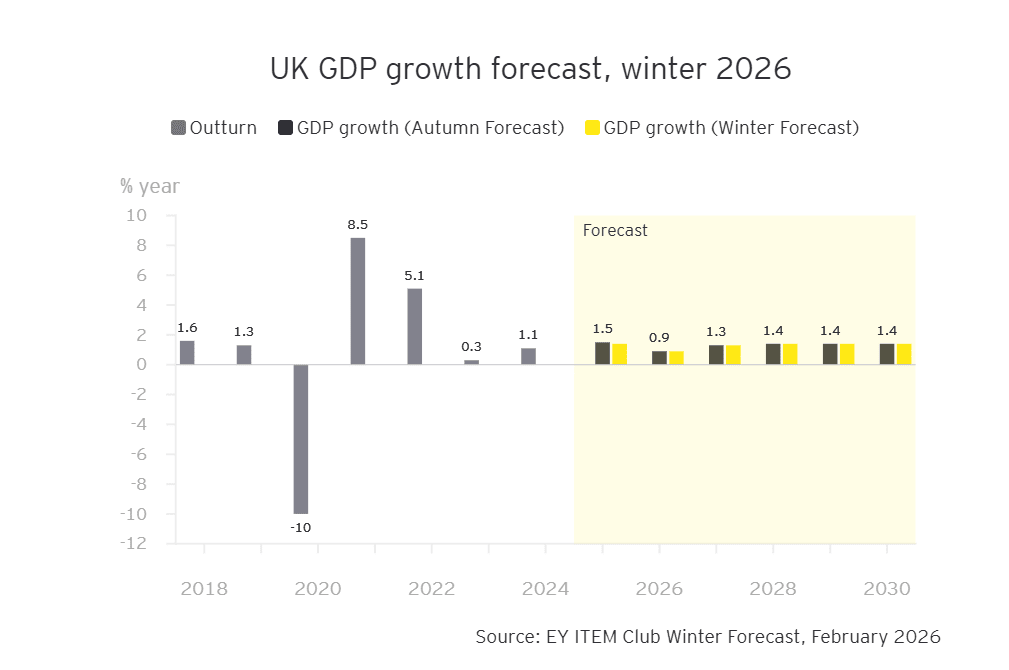

The EY ITEM Club expects UK GDP to grow by 0.9% in 2026, a marginal upgrade on the 0.8% predicted in November’s Autumn Forecast, before accelerating to 1.3% in 2027 and settling at 1.4% from 2028 onwards.

The country’s unemployment rate rose to 5.2% in the three months to December 2025, slightly above market expectations. This marks its highest level since the three months to February 2021.

Markets Price 68% Exit Odds by June

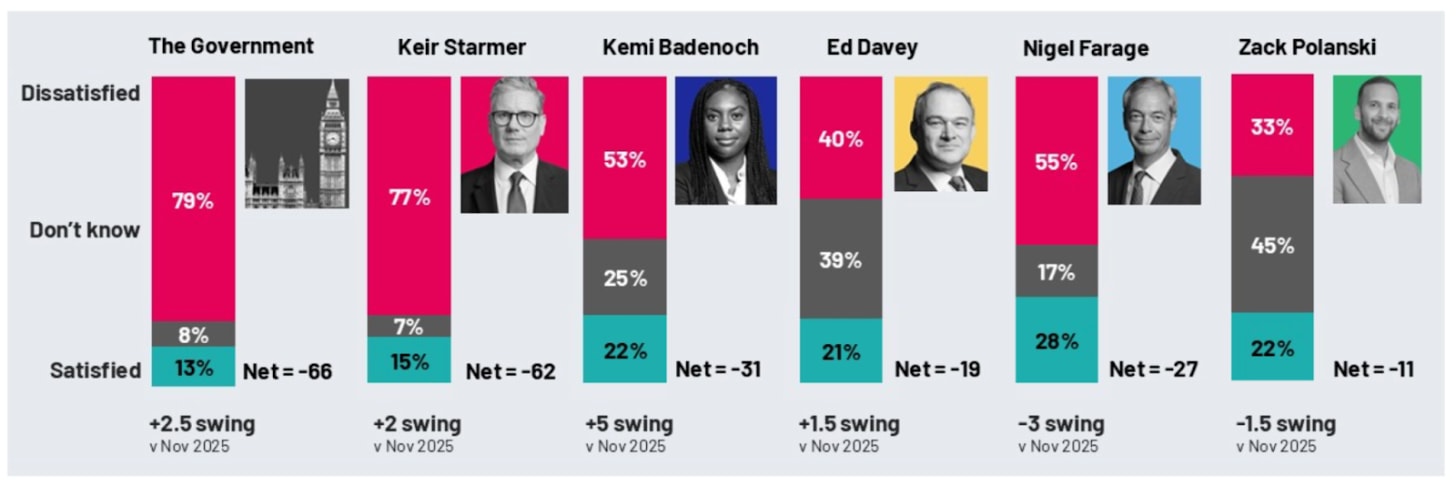

The fallout could further erode dwindling support for Starmer. He has recorded the lowest likeability rating among UK politicians, with over 70% of people saying they dislike the Prime Minister, Ipsos reported on February 6.

Reform UK’s leader Nigel Farage struck at Starmer during a Birmingham event on February 9. He declared that the “political life of the most unpopular and most useless prime minister in living memory is drawing to a close.”

“If the Mandelson affair brings down Starmer, the consequences would not stop at Downing Street,” Nigel Green, a CEO of London-based deVere Group, commented. “Markets would immediately focus on the UK bond – or gilt – market.”

Polymarket, a crypto-powered betting platform on political and cultural issues, priced a 68% probability of Starmer leaving by June.

Mandelson’s Corporate Ties Unravel

The UK’s Financial Conduct Authority (FCA) has yet to comment on investigating Mandelson. Corporate clients have cut ties preemptively.

Former Prime Minister Gordon Brown said on February 8 that Mandelson’s Epstein implications were a “financial crime.” The Liberal Democrats Party urged the FCA to launch insider-trading probes.

Barclays PLC (NYSE:BCS) dropped Mandelson’s Global Counsel in response to the Epstein fallout. Mandelson co-founded Global Counsel with Benjamin Wegg-Prosser in 2010.

Clients have included JPMorgan Chase & Co (NYSE:JPM), Barclays, Shell plc (NYSE:SHEL), GlaxoSmithKline plc (NYSE:GSK), and OpenAI, Inc.

Wegg-Prosser resigned as CEO of Global Counsel on February 6. Rebecca Park bought out Mandelson’s 21% stake for an undisclosed sum.

Epstein Allegations Reverberate in Europe

French prosecutors have investigated Lang and his daughter Caroline for “aggravated tax fraud and laundering.” Lang has denied all allegations through his lawyer, Laurent Merlet, calling them “inaccurate” and “unfounded conflations.”

In Norway, authorities charged Jagland after the Council of Europe lifted his immunity, which he enjoyed because of his past diplomatic role. He has denied criminal liability and is willing to cooperate, his lawyer says.

Emails released by the US government suggest Jagland planned solo and family visits to Epstein’s homes in Paris, New York, and Palm Beach after the billionaire was convicted of a child sex offence.

Norwegian Ambassador Mona Juul resigned following revelations that Epstein left her children $10 million in his will. Juul acknowledged in a statement to Norwegian news agency NTB that it had been “imprecise” to describe her contact with Epstein as minimal.

Norway’s Princess Implicated

Norway’s Crown Princess Mette-Marit appeared over 1,000 times in Epstein’s files. She stayed in touch through 2014 despite knowing Epstein’s past “didn’t look good.”

She visited his mansion, called him “sweetheart,” and exchanged pictures of naked women, according to the US documents.

“Confidence in the Crown Princess has fallen sharply,” Tove Taalesen, royal correspondent for Oslo-based Norwegian newspaper Nettavisen, said. “A majority still backs the institution, but that support is weaker, and uncertainty is growing.”

With investigations widening and political pressure intensifying, Europe’s leaders now face a scandal whose full impact has yet to be felt.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments