Clean Harbors Inc (NYSE:CLH) reported better-than-expected fourth-quarter financial results on Wednesday.

Clean Harbors reported quarterly earnings of $1.62 per share which beat the analyst consensus estimate of $1.61 per share. The company reported quarterly sales of $1.500 billion which beat the analyst consensus estimate of $1.466 billion.

“We concluded 2025 with strong fourth-quarter results, including higher profitability in both of our operating segments,” said Eric Gerstenberg, Co-Chief Executive Officer. “Our performance was led by our Environmental Services (ES) segment, where segment Adjusted EBITDA margin expanded year over year for the 15th consecutive quarter, reflecting the diversity of our end markets as we have continued to gain volumes against the muted industrial backdrop of the past several years. We believe that our results also demonstrate our consistency in executing our pricing initiatives, cost management plans and network efficiencies.”

Clean Harbors shares gained 2.7% to close at $276.25 on Wednesday.

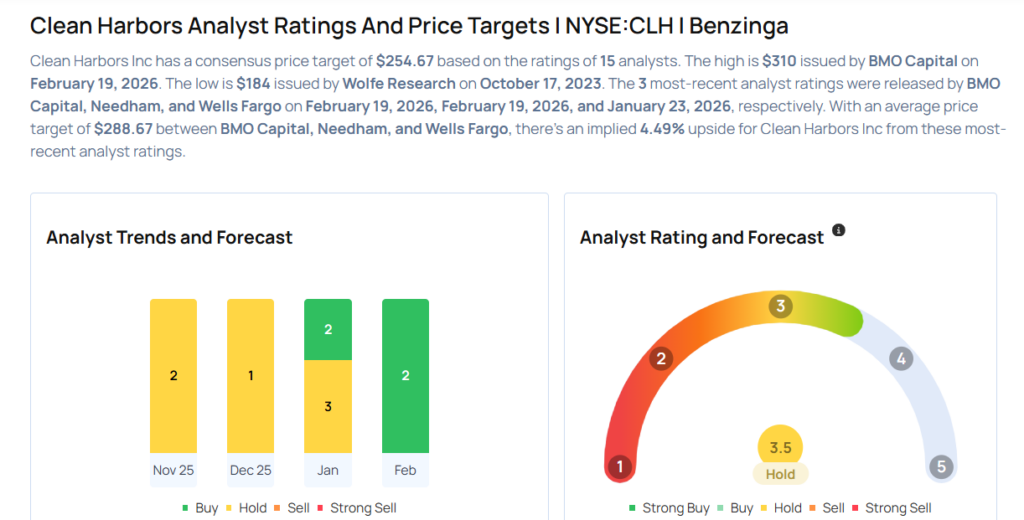

These analysts made changes to their price targets on Clean Harbors following earnings announcement.

- Needham analyst James Ricchiuti maintained Clean Harbors with a Buy and raised the price target from $290 to $308.

- BMO Capital analyst Devin Dodge maintained the stock with an Outperform rating and raised the price target from $290 to $310.

Considering buying CLH stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments