Carvana Co (NYSE:CVNA) reported upbeat sales for the fourth quarter after the market close on Wednesday.

Carvana reported fourth-quarter revenue of $5.60 billion, beating analyst estimates of $5.26 billion, according to Benzinga Pro. The company reported fourth-quarter earnings of $4.22 per share, which may not compare to estimates.

“In 2025, Carvana grew 43% year-over-year, delivered record unit economics, and passed significant value back to customers through better selection, faster delivery times and lower costs,” said Ernie Garcia, co-founder and CEO of Carvana.

Carvana expects significant growth in both retail units sold and adjusted EBITDA in 2026, including a sequential increase in both retail units sold and adjusted EBITDA in the first quarter. The company said it will ramp up its focus on driving significant profitable growth at scale this year.

Carvana shares fell 9.8% to $326.24 in pre-market trading.

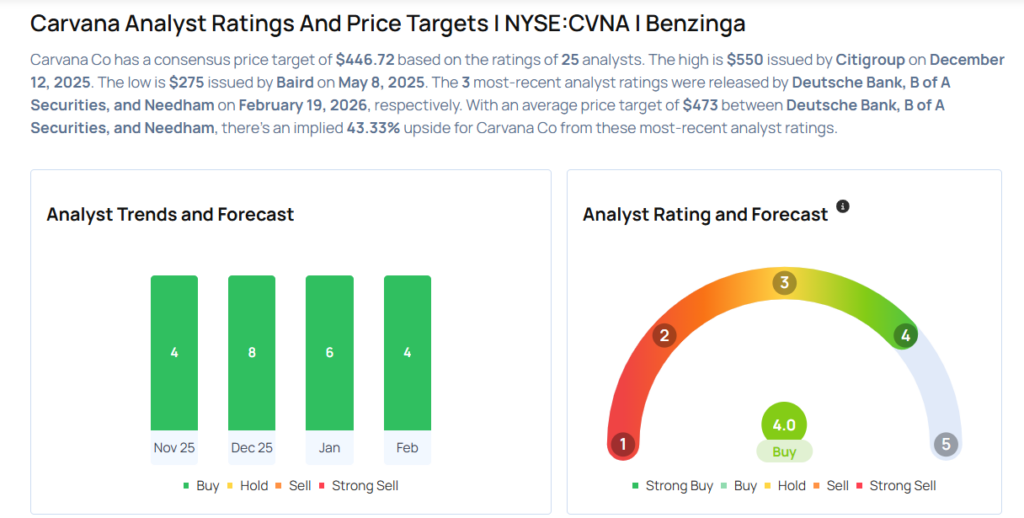

These analysts made changes to their price targets on Carvana following earnings announcement.

- BTIG analyst Marvin Fong maintained Carvana with a Buy and lowered the price target from $535 to $455.

- B of A Securities analyst Michael McGovern maintained the stock with a Buy and lowered the price target from $460 to $400.

- Deutsche Bank analyst Lee Horowitz maintained Carvana with a Buy and lowered the price target from $600 to $519.

Considering buying CVNA stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments