President Donald Trump claimed on Wednesday that his administration’s aggressive tariff policies have sparked a “staggering” 78% reduction in the U.S. trade deficit, vowing the nation will soon achieve its first trade surplus in decades.

A Milestone In Trade Policy?

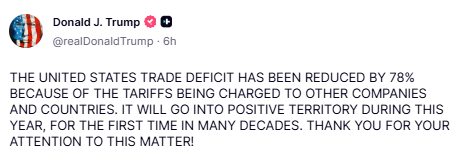

In an all-caps post on Truth Social, the President lauded the impact of his global “reciprocal tariffs,” which targeted over 100 countries starting in April 2025.

Trump attributed the contraction directly to these duties, stating, “The United States trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries”.

He added that the trade balance is expected to “go into positive territory during this year, for the first time in many decades”.

The President’s remarks come just ahead of the Feb. 19 release of official December trade data. Supporters view the potential shift as a validation of the Liberation Day tariffs, which were introduced as a “declaration of economic independence” for American workers.

Market Volatility And Data Discrepancies

Despite the President’s optimistic outlook, recent government data reveals a more complex and volatile economic landscape. While Trump has lauded a sharp contraction from early 2025 peaks, the U.S. trade deficit actually surged by nearly 95% in November 2025, reaching $56.8 billion.

This reversal followed a narrow October deficit of $29.2 billion, fueled by a 3.6% drop in exports and a 5.0% rise in imports.

Despite the President’s victory lap, for the first 11 months of 2025, the total trade deficit remained 4.1% higher than in the previous year. Furthermore, reports indicate that nearly 90% of tariff costs are currently being borne by U.S. businesses and consumers.

Blue Chips Gain As Tech Lags In 2026

As of Wednesday’s close, the Dow Jones index rose 2.65% year-to-date, whereas the S&P 500 was 0.33% higher and the Nasdaq Composite index was down 2.07% in 2026.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed higher on Wednesday. The SPY was up 0.50% at $686.29, while the QQQ advanced 0.75% to $605.79.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments