Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) CEO Sundar Pichai has acknowledged concerns about an AI bubble but said that the company’s investments in AI are strategic and justified by technological progress.

Pichai On AI Investments And The Bubble Debate

Speaking Wednesday evening at a media event ahead of his keynote speech at the India AI Impact Summit 2026, Pichai joked about trying to “avoid this question” on the AI bubble but quickly underscored the transformative potential of AI.

He compared the current AI revolution to an industrial revolution, “but 10 times faster and 10 times larger,” stressing that investments in AI infrastructure and innovation are essential to capture long-term growth.

“We live in a truly global world… [these] investments make sense given the progress in the technology we are seeing and the opportunities on top of it,” Pichai said.

He highlighted that Google’s AI work underpins multiple businesses, from Search and YouTube to Cloud and experimental projects like Waymo and Isomorphic Labs, illustrating how foundational AI is to future growth.

Demis Hassabis On AGI And The Human Role

DeepMind co-founder and CEO Demis Hassabis addressed the ongoing debate around artificial general intelligence. He described AGI as a long-term goal, stating that today’s AI tools are enhancements to human expertise rather than replacements.

He stressed the potential of AI to tackle global challenges in medicine, climate and inequality, while cautioning that technical and economic risks must be managed responsibly.

James Manyika On Jobs, Skills And AI

James Manyika, SVP of Research, Labs, Technology & Society at Google, highlighted the impact of AI on employment.

He urged governments and organizations to focus on upskilling, task-based workforce planning, and innovation-driven growth.

“Investing in skills and literacy and so forth, I think, is foundationally important,” Manyika said.

He noted that understanding AI’s effect on specific tasks, not just jobs, is key to preparing a young workforce for the evolving labor market.

During the event, Google also announced a $15 billion plan to boost AI development in India.

Price Action: Alphabet Class A shares gained 0.43% during Wednesday’s regular session while Class C shares were up 0.37%, according to Benzinga Pro.

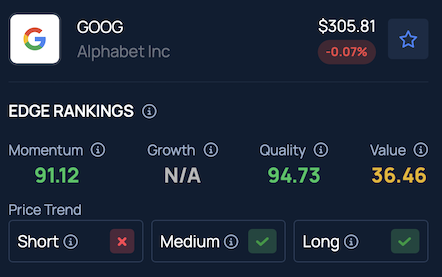

GOOG ranks high for Quality in Benzinga’s Edge Stock Rankings and shows steady medium- and long-term price trends, despite experiencing short-term headwinds.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: MNAphotography on Shutterstock.com

Recent Comments