Rocket Lab Corp (NASDAQ:RKLB) shares are trading higher Wednesday afternoon amid escalating geopolitical tensions overseas. The move follows a choppy trailing month that left the stock down roughly 16%. Here’s what investors need to know.

- Rocket Lab shares are powering higher. Why is RKLB stock up today?

Space, Defense Sentiment Improves

The rally comes alongside broader strength in aerospace, defense and space stocks Wednesday afternoon. Sector ETFs climbed 2% as traders reacted to reports of rising tensions between the United States and Iran and the prospect of expanded military action, with Rocket Lab among the day’s notable gainers.

Space names have been under pressure in 2026 amid chatter about a potential $1.5 trillion SpaceX IPO, which has drawn capital away from rivals and pressured Rocket Lab shares.

Hypersonic Pipeline, Catalysts Ahead

Recent news has centered on defense-linked growth. Rocket Lab last week detailed its Cassowary Vex mission, slated for late February and representing a fourth hypersonic test in under six months using the HASTE vehicle for the Defense Innovation Unit. The program aims to lower costs and increase test cadence for the U.S. and allies.

Mixed Short-Term Technical Outlook

The stock is currently trading 4.1% below its 20-day simple moving average (SMA) but is 1.2% above its 50-day SMA, indicating a mixed short-term outlook.

Over the past 12 months, shares have increased 170.19% and are currently positioned closer to their 52-week highs than lows, reflecting strong long-term performance.

The RSI is at 45.25, which is considered neutral territory, suggesting that the stock is neither overbought nor oversold at this time. Meanwhile, the MACD is at -2.5583, below its signal line of -0.6977, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, indicating that traders should watch for potential shifts in market sentiment.

- Key Resistance: $80.00

- Key Support: $67.00

Rocket Lab Earnings Preview

The countdown is on: Rocket Lab is set to report earnings on Feb. 26.

- EPS Estimate: Loss of 9 cents (Up from Loss of 10 cents)

- Revenue Estimate: $178.07 million (Up from $132.39 million)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $64.00. Recent analyst moves include:

- Goldman Sachs: Neutral (Raises Target to $69.00) (Jan. 20)

- B of A Securities: Buy (Raises Target to $120.00) (Jan. 20)

- Morgan Stanley: Upgraded to Overweight (Raises Target to $105.00) (Jan. 16)

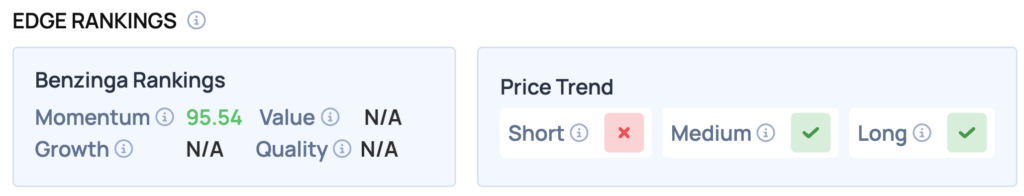

Benzinga Edge Data

Benzinga Edge stock rankings show Rocket Lab carries a strong Momentum score of 95.54, underscoring its powerful recent price action relative to peers.

RKLB Shares Surge Wednesday

RKLB Price Action: Rocket Lab shares were up 6.37% at $74.33 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments