Medtronic PLC (NYSE:MDT) posted better-than-expected earnings for the third quarter on Tuesday.

The company posted adjusted EPS of $1.36, beating market estimates of $1.33. The company’s quarterly sales came in at $9.017 billion, versus expectations of $8.905 billion.

Medtronic affirmed its FY2026 adjusted EPS guidance of $5.62-$5.66, versus market estimates of $5.65.

“This quarter, we again delivered accelerated growth while investing decisively in our future,” said Thierry Piéton, Medtronic CFO. “We continued to invest in R&D to strengthen our innovation pipeline, funded significant growth opportunities while driving G&A leverage, and we executed on our M&A and venture strategy with two key transactions in the quarter. Bottom line, we are executing on our roadmap and positioning the business for sustainable growth.”

Medtronic shares rose 0.1% to $96.45 in pre-market trading.

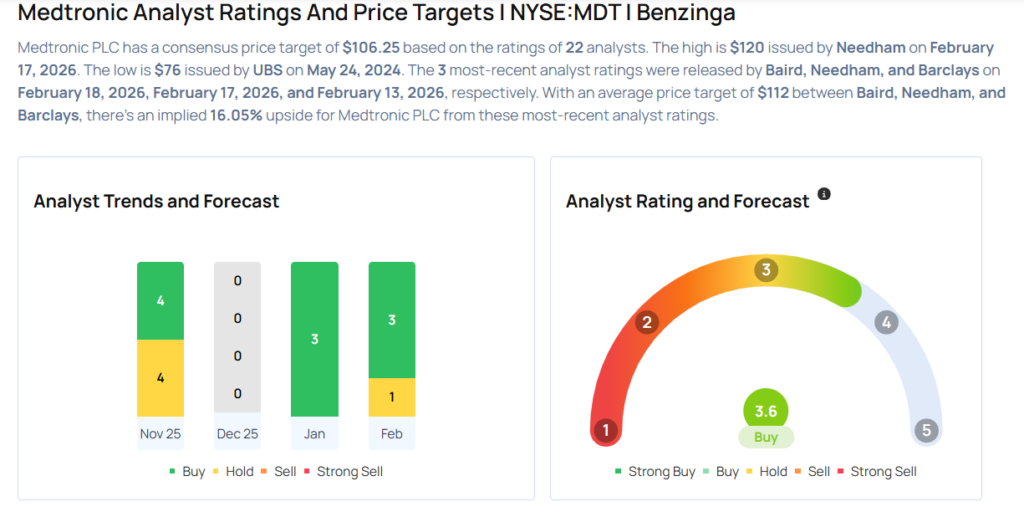

These analysts made changes to their price targets on Medtronic following earnings announcement.

- Needham analyst Mike Matson maintained Medtronic with a Buy and lowered the price target from $121 to $120.

- Baird analyst David Rescott maintained the stock with a Neutral and lowered the price target from $103 to $100.

Considering buying MDT stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments