Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong acknowledged on Tuesday that the company is “misunderstood” on Wall Street, stating that some traditional finance players have not been able to stomach the cryptocurrency “disruption.”

Is TradFi Skeptical Of Crypto?

In an X post, Armstrong said that while one section has been “leaning” and “embracing” cryptocurrency, the other half has been “resisting.”

“I think some of these people are just inherently skeptical of crypto because of incentives – their whole careers have been built in the traditional financial system,” the cryptocurrency mogul argued. “They’re skeptical because it feels like a threat.”

Citing Uber Technologies Inc. (NYSE:UBER) as an example, Armstrong said taxi companies would naturally view the ridesharing model unfavorably.

“Crypto is directly disrupting Wall Street, so it makes sense that some on Wall Street would misunderstand crypto/Coinbase,” he said. “The laggards are going to be left behind.”

Armstrong said that Coinbase is not yet a consensus view among traditional analysts.

“I suggest looking at what a company says they’re going to do [and their track record of meeting it], not whether some analyst’s model said they beat or miss,” he added, claiming that Coinbase is in a “stronger” position.

Coinbase Records Jump In Annual Revenue

Coinbase’s fourth-quarter revenue for 2025 hit $1.78 billion, missing analyst estimates, but EPS came in strong at $0.66, beating forecasts. Full-year revenue reached $7.2 billion, a 9% increase from last year.

The stock has a consensus price target of $314.94 from 29 analysts. Based on the three most recent ratings, the average price target stands at $194, suggesting a potential upside of about 17.23%.

Coinbase’s Grievances

Coinbase withdrew its support for the cryptocurrency market structure bill, hours before lawmakers were set to vote on the legislation. The primary objection centered on a rule that would prohibit cryptocurrency platforms from paying rewards on idle stablecoin balances. The rule does not apply to traditional banks offering interest on dollar deposits.

Armstrong accused banks of stifling competition and urged lawmakers to create a “level playing field” while enacting legislation.

Price Action: Coinbase shares fell 0.32% lower in after-hours trading after closing 1.03% higher at $166.02 during Tuesday’s regular trading session, according to Benzinga Pro.

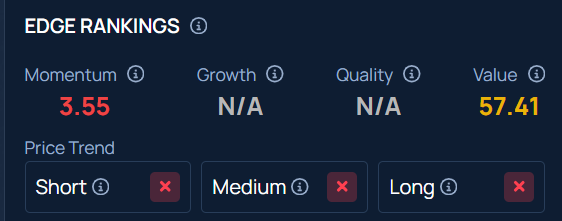

COIN stock maintains a weaker price trend in the short, medium, and long term, with an average Value ranking, according to Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock By Thrive Studios ID

Recent Comments