On Tuesday, CNBC’s Jim Cramer warned that competitors trying to reduce reliance on Nvidia Corp (NASDAQ:NVDA) could face tighter chip access after Meta Platforms, Inc. (NASDAQ:META) expanded its long-term AI infrastructure partnership with the chipmaker.

Cramer Flags GPU Supply Concerns After Meta–Nvidia Deal

Cramer reacted on X following the announcement from Meta and Nvidia, calling it a “surprise announcement” and a “huge commitment.”

He suggested companies aiming to build their own chips “may have to worry about allocations,” adding that “the smugness toward NVDA by any and all is tiresome.”

Meta Expands AI Infrastructure With Nvidia’s Full Stack

Under the agreement, Meta and Nvidia will collaborate closely across chips, networking and software to optimize AI training and inference workloads.

Nvidia founder and CEO Jensen Huang said the companies are engaging in “deep co-design across CPUs, GPUs, networking and software” to bring the full Nvidia platform to Meta’s engineers.

Meta plans to build advanced AI clusters using Nvidia’s next-generation Rubin platform. CEO Mark Zuckerberg said the expanded partnership will help deliver “personal superintelligence to everyone in the world.”

Meta has also adopted Nvidia’s Confidential Computing technology to improve WhatsApp’s private messaging and is using Nvidia’s Spectrum-X Ethernet platform to support AI-scale networking.

AI Compute Race Heats Up

Futurum Group CEO Daniel Newman said on X that “$META will buy and build compute and $NVDA is core to its mission,” describing the AI race as a battle for maximum compute capacity.

In a separate post, he added that Meta will “still buy $AMD btw. It is AND not Or,” underscoring that the company continues to diversify suppliers.

Meta Is Also Expanding Beyond Nvidia

Meta develops its own in-house silicon and has explored alternatives, including chips from Advanced Micro Devices, Inc. (NASDAQ:AMD) and other providers.

Meta is not exclusively dependent on Nvidia. In November 2025, it was reported that Meta was weighing the use of Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google’s tensor processing units in its data centers starting in 2027.

Meta is also designing its own custom silicon and sourcing chips from AMD, which secured a major agreement with OpenAI in October, as leading AI companies look to diversify beyond Nvidia amid ongoing supply constraints.

Still, Nvidia’s Blackwell GPUs remain back-ordered and Rubin chips have entered production.

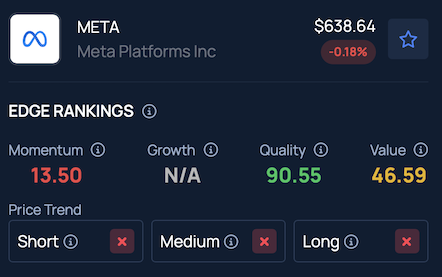

Price Action: At the time of writing, Meta shares are up 0.66% in after-hours trading, while Nvidia gained 0.79% during the same period, according to Benzinga Pro.

Meta stock earns a strong Quality rating in Benzinga’s Edge Stock Rankings, though its price trend remains negative across the short, medium and long-term periods.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: katz / Shutterstock.com

Recent Comments