Strategy Inc. (NASDAQ:MSTR) Executive Chair Michael Saylor said Tuesday that the ongoing “crypto winter” feels milder than past ones and will soon give way to a spring followed by a “glorious summer.”

Saylor’s Not Losing Sleep Over ‘Crypto Winter’

During an interview with Fox Business, Saylor responded to a question about the current state of the market.

“This is a much milder winter than previous winters,” the Bitcoin bull said. “It’ll be shorter than previous winters. It’s going to be followed by a spring and then a glorious summer.”

When pressed on why he is so confident, Saylor pointed out that institutions like banks are backing Bitcoin (CRYPTO: BTC) “much more strongly” than they did four years ago.

“We’ve got the formation of digital credit networks, banking credit networks. We’ve got the support of the administration. We’ve got a Bitcoin president,” he added, referring to President Donald Trump.

Saylor said that “new advances” in digital space are happening every month, bringing more capital to the asset class.

‘We’re Fairly Indestructible’

Saylor also expressed confidence in the resilience of his Bitcoin-hoarding company.

“The company’s balance sheet is a fortress. We’re fairly indestructible. Bitcoin can fall to any level. It won’t make much difference to us,” he claimed.

What Do Numbers Say?

Strategy currently holds 714,644 BTC at an average cost of $76,056. With Bitcoin trading near $67,000, the company’s holdings are underwater, triggering anxiety among investors.

Moreover, Strategy’s market valuation stands at $42.90 billion, while its Bitcoin holdings are valued at $48 billion.

However, Saylor has brushed off the downturn, stating that even at $8,000 per Bitcoin, Strategy’s holdings would fully cover its debt.

Earlier this month, he said that the company would convert its convertible debt into equity over the next three to six years.

Price Action: At the time of writing, BTC was exchanging hands at $67,351.93, down 2.89% over the last 24 hours, according to data from Benzinga Pro.

MSTR shares fell 0.48% in after-hours trading after closing 3.89% lower at $128.67 during Tuesday’s regular trading session.

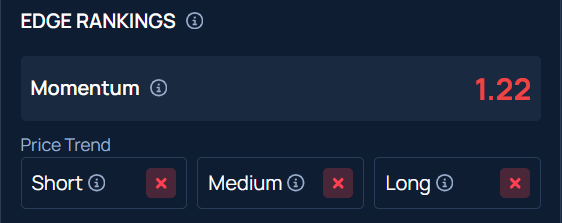

The stock shows weak price momentum across the short-, medium-, and long-term, earning a very low Momentum score in Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: vshtun on Shutterstock.com

Recent Comments