Fastly Inc (NASDAQ:FSLY) shares are pulling back Tuesday afternoon, though the stock remains up more than 100% over the past week following a strong earnings report that highlighted the company’s growing role in the rapidly expanding agentic AI market.

Returning from the Presidents’ Day holiday, Wall Street opened the week with familiar worries weighing on software and tech stocks, as investors continued to grapple with potential AI-driven disruption.

- Fastly stock is trending lower. Why is FSLY stock retreating?

AI Pivot Fuels Investor Optimism

The rally follows comments from CEO Kip Compton, who highlighted Fastly’s evolution into a key infrastructure provider for autonomous models and bots that navigate the web, a shift that has captured investor attention and boosted market confidence.

Fastly last week reported quarterly revenue of $172.6 million, a 23% year-over-year increase, while earnings per share came in at roughly double analyst estimates, marking an important inflection point for the company.

Compton noted that the rise of agentic AI is fundamentally reshaping internet traffic patterns, driving stronger demand for Fastly’s platform to manage this new wave of automated activity.

The company also issued 2026 revenue guidance of $700 million to $720 million, ahead of Wall Street expectations. Security revenue grew 32%, supported by products built to handle the unique challenges of AI-driven traffic, further strengthening Fastly’s competitive position.

Short-Term Weakness, Long-Term Strength

The stock is currently trading 2.7% below its 20-day simple moving average (SMA) and 4.1% below its 100-day SMA, indicating short-term weakness while the longer-term trend remains intact.

Over the past 12 months, shares have increased by 118.60%, and they are currently positioned much closer to their 52-week highs than lows, suggesting a relatively strong longer-term performance.

The RSI is at a neutral level, indicating that the stock is neither overbought nor oversold. Meanwhile, MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD indicates mixed momentum, reflecting the stock’s current indecisive state.

- Key Resistance: $19.00

- Key Support: $17.00

Analysts Raise Price Targets

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $10.91. Recent analyst moves include:

- Citigroup: Neutral (Raises Target to $13.00) (Feb. 13)

- RBC Capital: Sector Perform (Raises Target to $12.00) (Feb. 12)

- Piper Sandler: Neutral (Raises Target to $14.00) (Feb. 12)

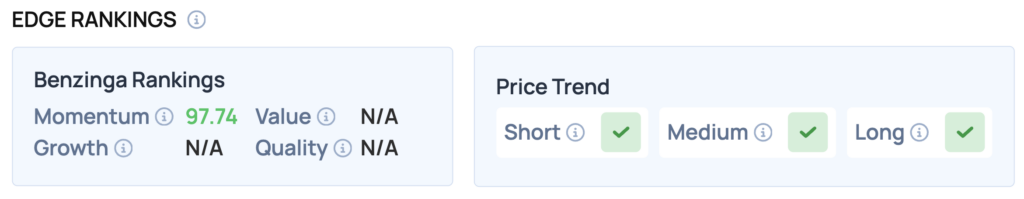

Benzinga Edge Rankings

Benzinga Edge data shows Fastly carries a standout Momentum score of 97.74, placing it among the market’s strongest-performing stocks.

FSLY Price Action: Fastly shares were down 4.00% at $17.53 at the time of publication on Tuesday. The stock is near its 52-week high of $19.14, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments