Short sellers aren’t betting against tech broadly anymore — they’re targeting its most crowded trade. New short interest data shows bearish bets against the Technology Select Sector SPDR Fund (NYSE:XLK) have surged dramatically, even as short sellers quietly retreat from the broader Nasdaq.

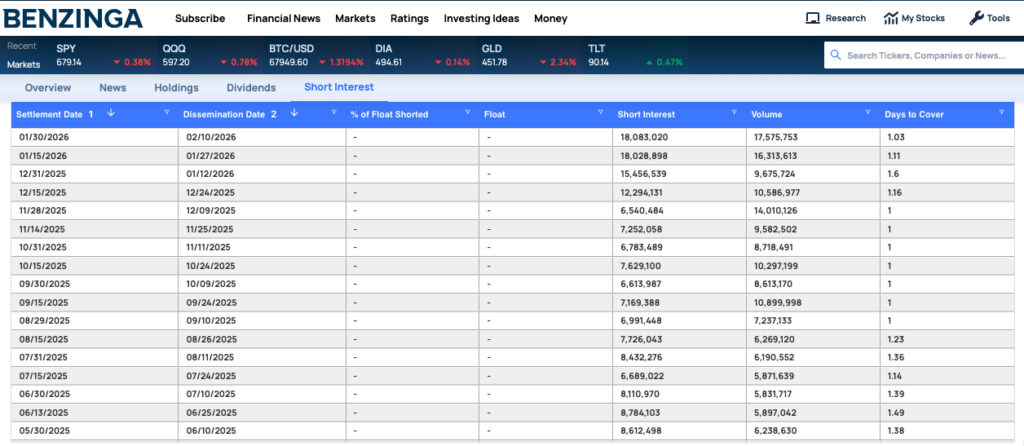

Shares sold short in XLK have jumped from roughly 6.5 million in November to over 18 million by late January, nearly tripling in just two months, according to Benzinga Pro data.

At the same time, short interest in the Invesco QQQ Trust (NASDAQ:QQQ) has moved in the opposite direction. Shares sold short have fallen from nearly 54 million last summer to about 46 million, signaling that bearish bets against the broader Nasdaq are being unwound.

Nvidia Concentration Is Driving Targeted Shorting

The divergence comes down to one key difference: concentration. XLK has evolved into a far more concentrated bet on AI-driven mega-cap tech, with Nvidia Corp (NASDAQ:NVDA) now its largest holding at over 15%, followed by Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT). Together, the trio accounts for nearly 40% of the ETF.

By contrast, Nvidia represents less than 9% of QQQ, which spreads its exposure across a broader mix including Amazon.com Inc (NASDAQ:AMZN), Meta Platform Inc (NASDAQ:META), Tesla Inc (NASDAQ:TSLA), and even defensive names like Costco Wholesale Corp (NYSE:COST) and Walmart Inc (NYSE:WMT).

This makes XLK a cleaner and more efficient vehicle for hedge funds looking to hedge or bet against the AI-heavy leadership that has powered the market’s gains.

Hedge Funds Are Hedging Leadership, Not Tech Itself

The sharp rise in XLK short interest alongside falling QQQ shorts suggests institutional investors aren’t turning bearish on tech as a whole. Instead, they’re hedging concentration risk — specifically the handful of mega-cap AI stocks that have driven outsized returns.

Importantly, this kind of targeted shorting often reflects risk management rather than outright directional bets. Crucially, days-to-cover ratios remain low — about 1 to 1.6 days for XLK — signaling this isn’t panic shorting. Instead, it points to calculated institutional hedging against concentrated AI leadership rather than a broad bearish bet on tech.

With Nvidia, Apple, and Microsoft carrying massive index weightings, even small shifts in sentiment can have outsized market impact.

For now, the message from short sellers is clear: the broader Nasdaq trade remains intact — but the AI-led leadership driving it is facing its first real wave of skepticism.

Photo: Shutterstock

Recent Comments