Despite Amazon.com Inc. (NASDAQ:AMZN) enduring its worst losing streak in two decades, Futurum Chief Research Officer David Nicholson argues the market’s aggressive sell-off is driven by anxiety rather than a shift in business fundamentals.

Market Sentiment Vs. Reality

Amazon recently faced a historic nine-day losing streak, its longest since 2006, resulting in a staggering $400 billion wipeout in market capitalization.

The decline saw shares slide 18.19% in these nine days and 12.23% year-to-date, which was largely triggered by concerns over massive capital expenditure (CapEx) targets for AI infrastructure. However, Nicholson suggests this is a psychological phenomenon rather than a structural failure.

“Nothing has fundamentally changed,” Nicholson said during an interview with Schwab Network on Market on Close. “I think that this has been a case of the world between our ears changing while the world around us stays the same”.

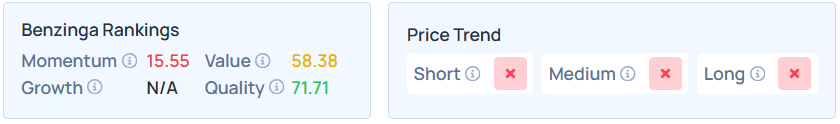

AMZN maintains a weaker price trend over the long, short, and medium terms, with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

The AI ‘Game Of Chicken’

The core of the investor panic lies in the timeline for seeing returns on AI investments. Nicholson characterized the current trading environment as a high-stakes standoff between big tech and Wall Street.

“It feels like a ‘game of chicken,’” Nicholson explained. “How long can we keep these bets on the table without seeing what we believe are tangible, positive ROI movements from these firms?”

He emphasized that while investors are getting “anxious,” the actual go-to-market strategy for AI remains a robust growth industry that justifies long-term, balanced portfolios.

Enterprise Stability And The SaaS Moat

Addressing fears that AI might cannibalize the software sector, Nicholson noted that enterprise-level clients remain risk-averse.

He believes major players like Salesforce Inc. (NYSE:CRM) and ServiceNow Inc. (NYSE:NOW) are protected by their roles as trusted filters for new technology.

While he acknowledged that “at the margins, there is going to be a lot of pressure on traditional legacy SaaS providers,” he dismissed the idea that AI models would immediately displace established giants.

“People aren’t going to come in and build their own tools in the enterprise,” he concluded, reinforcing that current market volatility is a “reflection of sentiment” rather than a new negative reality for the AI space.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: bluestork / Shutterstock

Recent Comments