Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong said on Sunday that retail users on the cryptocurrency exchange showed strong resilience in the ongoing market downturn, steadily purchasing Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) during the dips.

Coinbase Encountering Retail Accumulation

Armstrong highlighted on X a rise in native Bitcoin and Ethereum units held by retail users on the platform.

“They’ve been buying the dip,” he stated. “They have diamond hands – vast majority of customers had native unit balances in Feb equal to or greater than their balances in December.”

What Do Indicators Reveal?

It’s worth noting that Google search interest for Bitcoin reached a 5-month high in February, aligning with the top cryptocurrency’s steep drop toward $60,000.

Additionally, Binance retail traders in derivatives showed strong Bitcoin optimism, with a Long/Short ratio of 1.90, according to Coinglass.

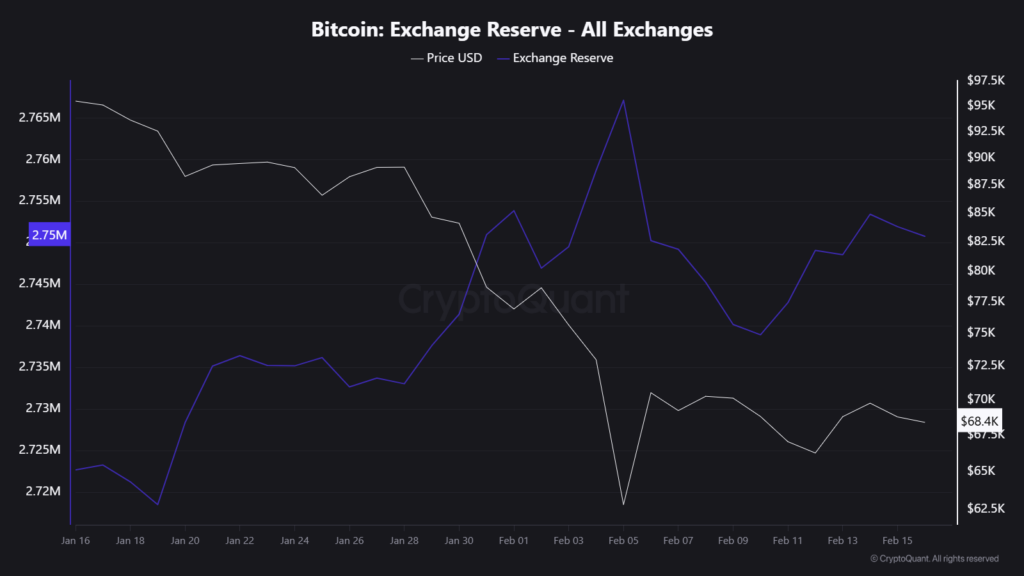

Another key on-chain metric is Bitcoin Exchange Reserve. Notice how they spiked sharply before Bitcoin’s sell-off, then steadily dropped, indicating that investors are withdrawing coins for long-term HODLing.

Coinbase’s fourth-quarter revenue for 2025 hit $1.78 billion, missing analyst estimates, but EPS came in strong at $0.66, beating forecasts. Full-year revenue reached $7.2 billion, a 9% increase from last year.

During the earnings call, Armstrong stated that the company has the ability to launch its own prediction market business, beyond serving as a retail distributor for platforms like Kalshi.

Price Action: Coinbase shares closed 16.46% higher at $164.32 during Friday’s regular trading session, according to Benzinga Pro.

COIN stock maintains a weaker price trend in the short, medium, and long term, with an average Value ranking, according to Benzinga’s Edge Stock Rankings.

Image via Shutterstock By Thrive Studios ID

Recent Comments