Unity Software Inc (NYSE:U) shares are tumbling on Friday following a disappointing outlook for the first quarter, which has raised concerns among investors. Here’s what investors need to know.

- Unity Software stock is showing notable weakness. What’s behind U decline?

Strong Quarter, Weak Outlook

Unity Software on Wednesday reported strong fourth-quarter results, including total revenue of $503 million, surpassing consensus estimates. However, the company’s guidance for the first quarter fell short, projecting revenue between $480 million and $490 million, which is below analyst expectations.

Analysts have noted that the company’s sequential growth in its advertising segment, Vector/Unity Ads, was only 15%, missing the anticipated 20%. Additionally, there are concerns regarding the potential closure of the ironSource ad operation, which could impact future revenue growth.

Technical Weakness Deepens Further

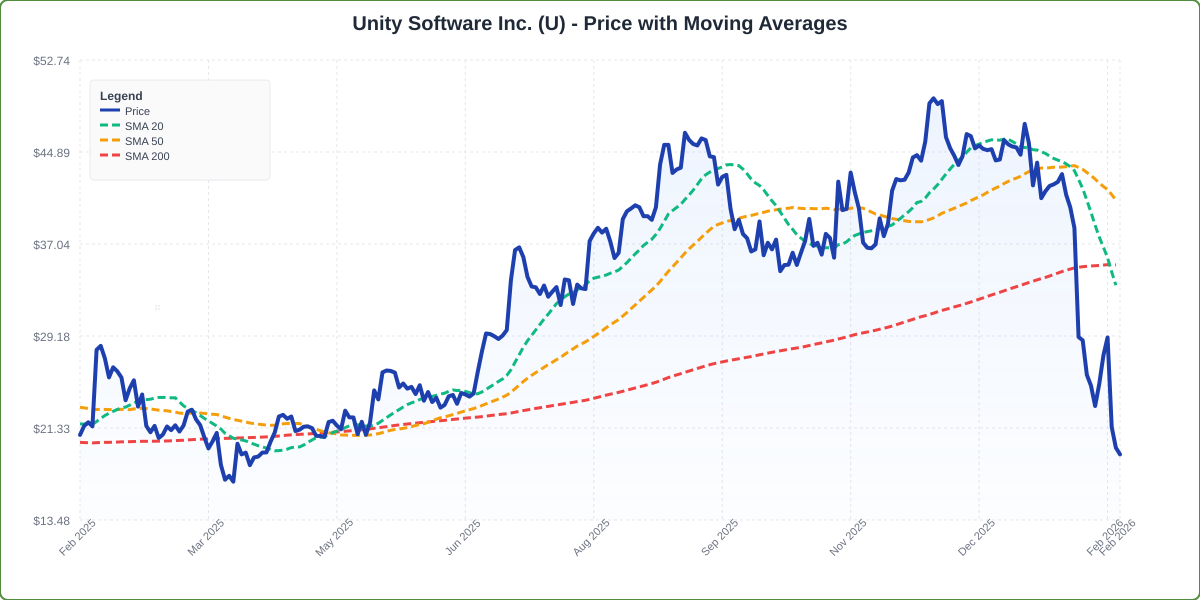

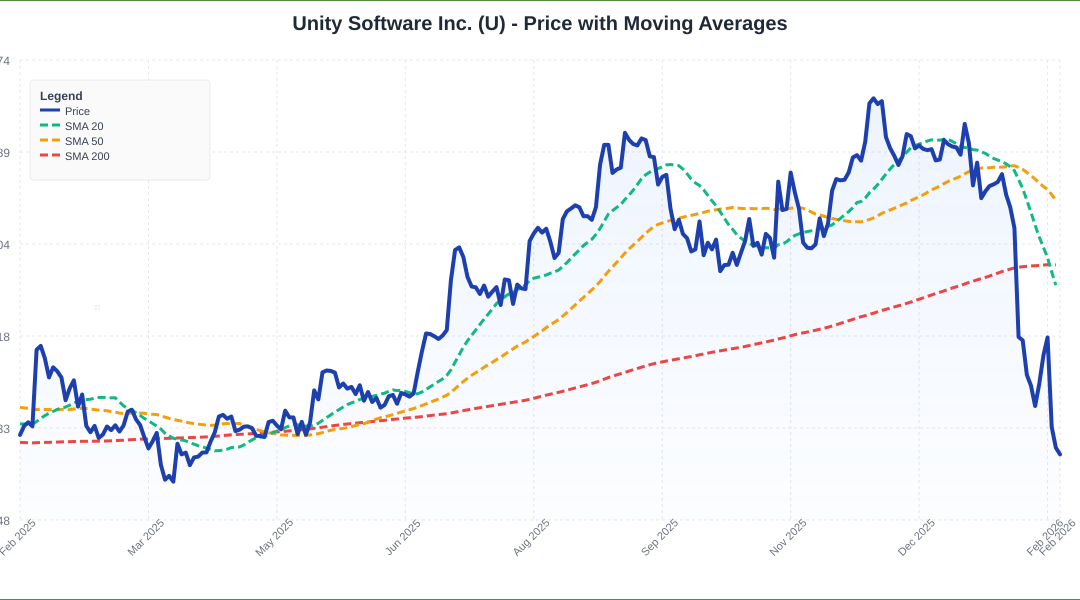

The technical indicators paint a concerning picture for Unity. The stock is currently trading 43% below its 20-day simple moving average (SMA) and 52% below its 100-day SMA, indicating significant weakness in its price action.

Over the past 12 months, shares have decreased by 7.62%, and they are currently positioned closer to their 52-week lows than highs.

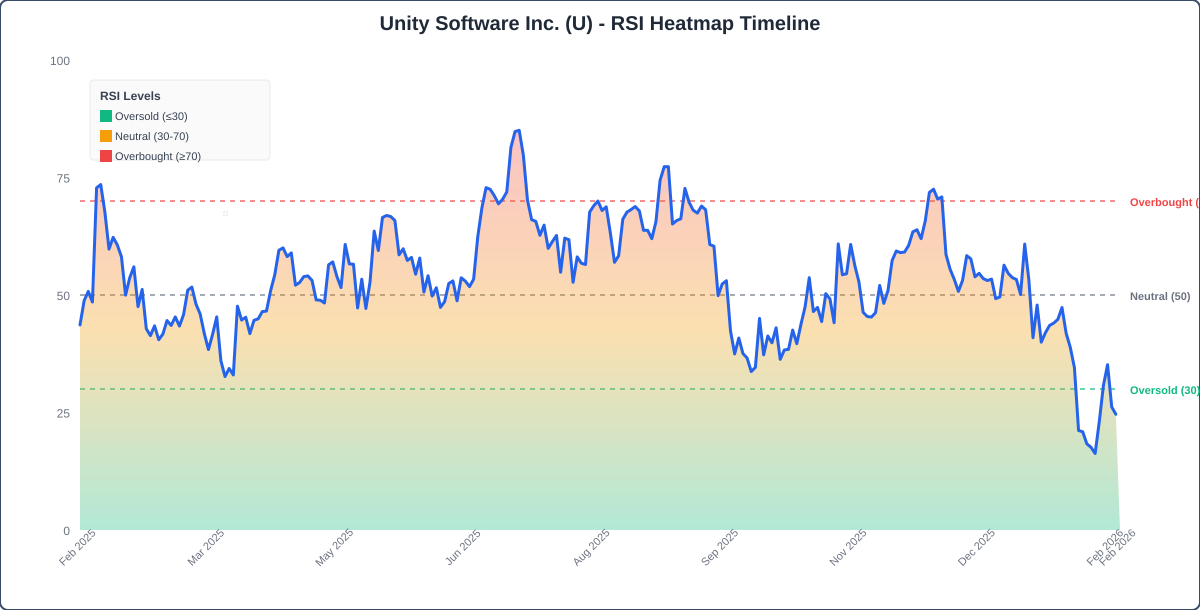

The RSI is at 24.55, indicating that the stock is oversold, while the MACD is below its signal line, suggesting bearish momentum. This combination of indicators highlights a challenging environment for Unity, as it struggles to gain traction in the current market.

- Key Resistance: $20.00

- Key Support: $15.50

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Unity Software, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: 8.84 — The stock is showing weak momentum.

Analysts Trim Price Targets

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $38.13. Recent analyst moves include:

- Macquarie: Outperform (Lowers Target to $37.00) (Feb. 12)

- Citigroup: Buy (Lowers Target to $43.00) (Feb. 12)

- UBS: Neutral (Lowers Target to $26.00) (Feb. 12)

Unity Software Shares Drop Friday

U Price Action: Unity Software shares were down 4.15% at $18.83 at the time of publication on Friday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments