TransUnion (NYSE:TRU) reported upbeat earnings for the fourth quarter on Thursday.

The company posted quarterly earnings of $1.07 per share which beat the analyst consensus estimate of $1.02 per share. The company reported quarterly sales of $1.171 billion which beat the analyst consensus estimate of $1.134 billion.

TransUnion said it sees FY2026 adjusted EPS of $4.63-$4.71 versus market estimates of $4.82. The company sees sales of $4.946 billion-$4.981 billion, versus estimates of $4.927 billion.

“TransUnion finished the year strongly with results that again exceeded financial guidance,” said Chris Cartwright, President and CEO. “Revenue growth of 13 percent was led by continued strength in U.S. Markets, with Financial Services growing 19 percent and Emerging Verticals accelerating to 16 percent growth. Results reflected broad-based performance, with credit, marketing and fraud solutions each growing healthy double-digits.”

TransUnion shares gained 4.6% to trade at $74.09 on Friday.

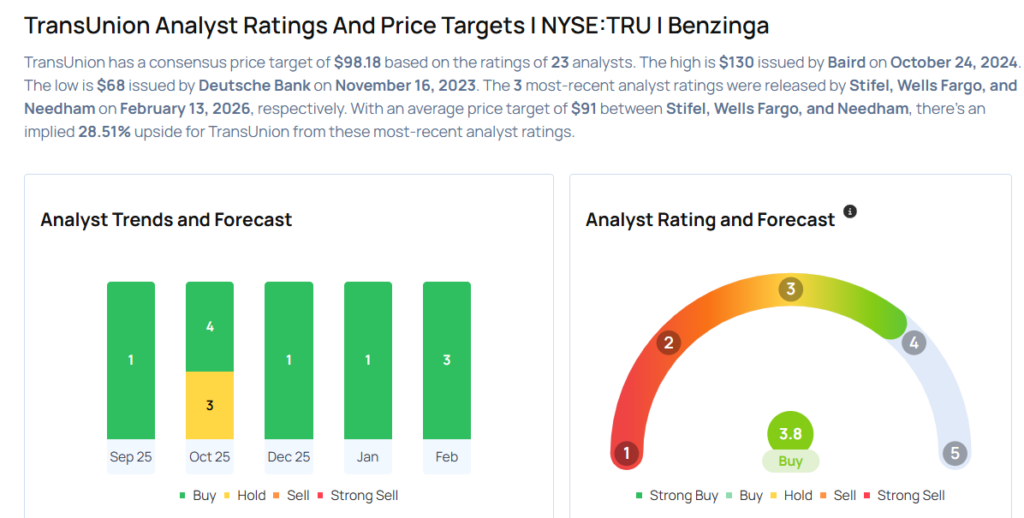

These analysts made changes to their price targets on TransUnion following earnings announcement.

- Needham analyst Kyle Peterson maintained TransUnion with a Buy and lowered the price target from $115 to $95.

- Wells Fargo analyst Jason Haas maintained the stock with an Overweight rating and lowered the price target from $100 to $90.

- Stifel analyst Shlomo Rosenbaum maintained TransUnion with a Buy and lowered the price target from $103 to $88.

Considering buying TRU stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments