Editor’s note: This article was updated to add more details and context.

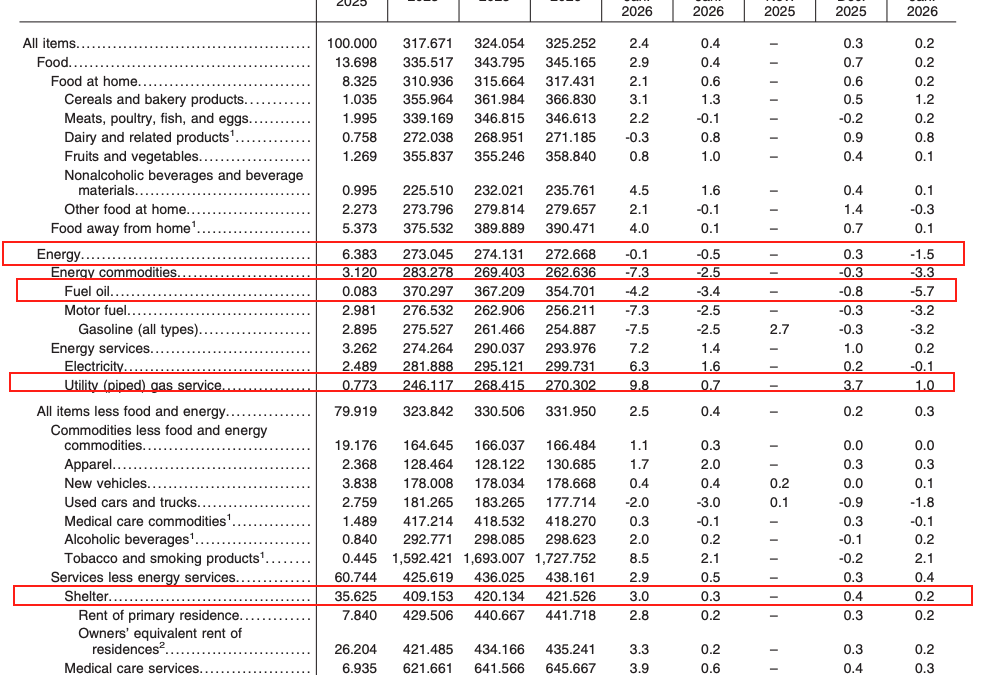

Price pressures in the U.S. eased at the start of 2026, with the annual rate of consumer-price inflation slowing from 2.7% in December to 2.4% in January.

The reading was below economist expectations of 2.5% and marked the lowest inflation print since May 2025.

On a monthly basis, headline CPI rose 0.2%, slightly below both the prior reading and consensus estimates of 0.3%.

Core inflation — which excludes food and energy — also cooled, edging down from 2.6% year over year in December to 2.5% in January, as expected. This marked the lowest core inflation reading since March 2021.

Month over month, core CPI increased 0.3%, meeting forecasts and ticking up slightly from December’s 0.2% gain.

Where Inflation Is Rising Or Falling

Shelter costs remained a key inflation driver. The index for shelter rose 0.2% in January and was the largest contributor to the overall monthly increase in the all-items index, underscoring the ongoing stickiness in housing-related expenses.

Energy remained a drag, with the subindex for energy items dropping 1.5% on the month. Fuel oil inflation dropped 5.7% monthly, yet utility gas-piped service surged 1%, likely reflecting higher heating demand during January’s cold snap.

Inflation gains were also visible in airline fares – which recorded the highest monthly increase at 6.5% – tobacco and smoking products, and transportation services.

Declines were observed in used cars and trucks, falling 1.8%, and motor vehicle insurance, down 0.4%.

Market Reactions

U.S. equity indices inched higher in premarket trading in New York, with futures on the S&P 500 reversing earlier losses as investors welcomed the lower-than-expected inflation data.

In commodities, precious metals rallied sharply.

Gold futures – as tracked by the SPDR Gold Shares (NYSE:GLD) – climbed 1.3% to $4,985 per ounce, while silver futures surged nearly 5% to $78.72 per ounce.

Image: Shutterstock

Recent Comments