The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

NU Skin Enterprises Inc (NYSE:NUS)

- On Feb. 12, Nu Skin Enterprises reported worse-than-expected fourth-quarter financial results and issued FY26 guidance below estimates. “We are pleased to achieve fourth quarter results within our guidance range for both revenue and earnings per share,” said Ryan Napierski, Nu Skin president and CEO. The company’s stock fell around 3% over the past five days and has a 52-week low of $5.32.

- RSI Value: 29.9

- NUS Price Action: Shares of NU Skin rose 0.4% to close at $10.21 on Thursday.

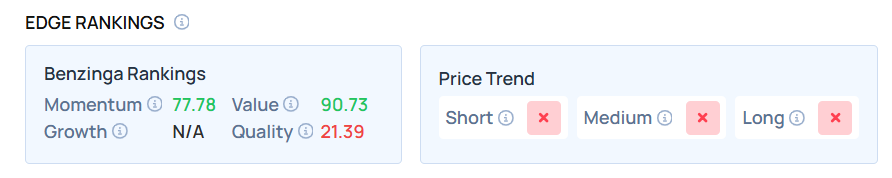

- Edge Stock Ratings: 77.78 Momentum score with Value at 90.73.

Coty Inc (NYSE:COTY)

- On Feb. 5, Coty reported mixed second-quarter financial results. Also, the company said it anticipates Q3 gross margin to be pressured due to lower net sales and impact from tariffs. “I’m truly excited and energized to join Coty at this pivotal moment,” said Markus Strobel, Executive Chairman and Interim Chief Executive Officer. The company’s stock fell around 22% over the past month and has a 52-week low of $2.44.

- RSI Value: 29.5

- COTY Price Action: Shares of Coty fell 1.2% to close at $2.50 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in COTY stock.

Honest Company Inc (NASDAQ:HNST)

- The Honest Company will report fourth quarter and full year 2025 financial results on Feb. 25. The company’s stock fell around 18% over the past month and has a 52-week low of $2.07.

- RSI Value: 25.6

- HNST Price Action: Shares of Honest fell 1.9% to close at $2.10 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in HNST shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments