U.S. stock futures were swinging between gains and losses on Friday following Thursday’s lower close. Futures of major benchmark indices were mixed.

Investors are awaiting the January inflation print as experts like Tom Lee estimate the core CPI year-over-year to drop to 2.52%—matching the 2017-2019 average and signaling a return to pre-COVID inflation.

Meanwhile, the 10-year Treasury bond yielded 4.12%, and the two-year bond was at 3.47%. The CME Group’s FedWatch tool‘s projections show markets pricing a 92.1% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | -0.13% |

| S&P 500 | 0.02% |

| Nasdaq 100 | 0.13% |

| Russell 2000 | -0.08% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.069% at $681.74, while the QQQ advanced 0.16% to $601.61.

Stocks In Focus

Roku

- Roku Inc. (NASDAQ:ROKU) jumped 13.70% in premarket on Friday after reporting better-than-expected fourth-quarter financial results and issuing FY26 sales guidance above estimates. Roku reported quarterly earnings of 53 cents per share, which beat the consensus estimate of 27 cents by 93.43%

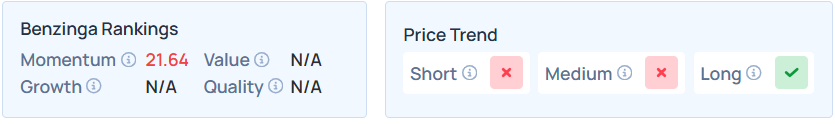

- ROKU maintains a stronger price trend over the long term but a weak trend in the short and medium terms, as per Benzinga’s Edge Stock Rankings.

Arista Networks

- Arista Networks Inc. (NYSE:ANET) gained 12.12% after posting upbeat fourth-quarter earnings and issuing strong guidance. Arista reported quarterly earnings of 82 cents per share, which beat the Street estimate of 76 cents.

- ANET maintains a stronger price trend over the short, medium, and long terms, with a solid growth ranking, as per Benzinga’s Edge Stock Rankings.

Tri Pointe Homes

- Tri Pointe Homes Inc. (NYSE:TPH) surged 25.79% after it announced an all-cash strategic combination with Sumitomo Forestry to create a U.S.-based homebuilder.

- Benzinga’s Edge Stock Rankings indicate that TPH maintains a stronger price trend over the short, medium, and long terms, with a poor quality ranking.

HIVE Digital Technologies

- HIVE Digital Technologies Ltd. (NASDAQ:HIVE) advanced 2.34%, announced signing customer agreements representing approximately $30 million in total contract value over two-year fixed terms, subject to performance obligations and deployment milestones.

- Benzinga’s Edge Stock Rankings indicate that HIVE maintains a weaker price trend over the long, medium, and short terms.

Expedia Group

- Expedia Group Inc. (NASDAQ:EXPE) dropped 4.97% after reporting fourth-quarter earnings as the company issued a muted margin forecast for 2026, despite beating top and bottom-line analyst estimates.

- EXPE maintains a stronger price trend over the long term but a weak trend in the short and medium terms, with a moderate growth ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Information technology, energy, and financial stocks led the S&P 500’s decline on Thursday, while utilities and consumer staples trended upward.

| Index | Performance (+/-) | Value |

| Dow Jones | -1.34% | 49,451.98 |

| S&P 500 | -1.57% | 6,832.76 |

| Nasdaq Composite | -2.03% | 22,597.15 |

| Russell 2000 | -2.01% | 2,615.83 |

Insights From Analysts

In early 2026, Scott Wren, Senior Global Market Strategist at Wells Fargo Investment Institute, maintained a resilient outlook for the U.S. economy, recently raising the annual growth estimate to 2.9%. Wren views the domestic economy as a “gigantic aircraft carrier that is hard to knock off course,” expecting it to weather temporary market “stumbles and turmoil”.

Despite recent volatility that saw the S&P 500 Index drop approximately 3% from its January record high, Wren argues that such corrections represent “buying opportunities” rather than deteriorating fundamentals. He emphasizes looking “under the hood” to see that performance is broadening beyond technology into cyclical and value-oriented sectors. His key expectations include.

- Corporate Earnings: Anticipation of a fourth consecutive year of record earnings for the S&P 500.

- Monetary Policy: Expectations for further Federal Reserve easing and rate cuts as the year progresses.

- Investment Strategy: A preference for U.S. assets over international ones, specifically favoring sectors like Energy, Materials, and Industrials.

Wren advises investors to “look through the hand-wringing of the headlines,” remaining confident that the strengthening economy will eventually benefit a wider array of market sectors.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Friday.

- January’s consumer price index data will be released by 8:30 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.35% to hover around $63.06 per barrel.

Gold Spot US Dollar rose 0.91% to hover around $4,966.59 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.10% higher at the 97.0180 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.81% lower at $66,785.65 per coin.

Asian markets closed lower on Friday, as China’s CSI 300, India’s Nifty 50, Australia’s ASX 200, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s Kospi indices fell. European markets were mostly lower in early trade.

Recent Comments