Solaris Energy Infrastructure Inc. (NYSE:SEI) surged 12.26%, reaching $57.78 in after-hours trading on Thursday.

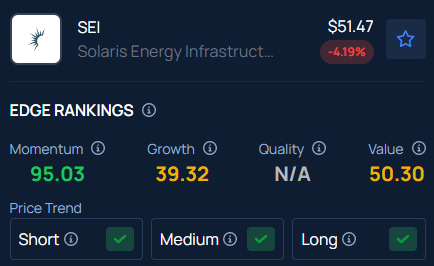

The stock closed the regular session at $51.47, down 4.21%, according to Benzinga Pro data.

Technology Company Agreement Details Revealed

Solaris Power Solutions LLC, an indirect subsidiary of Solaris Energy Infrastructure, entered into a Master Equipment Rental Agreement with Delaware-based limited liability company Hatchbo LLC on Thursday, according to a Securities and Exchange Commission filing.

Under the agreement, Solaris Power Solutions will provide over 500 megawatts of power generation equipment to support Hatchbo’s artificial intelligence computing needs at its data centers.

10-Year Rental Term Includes Early Termination Provisions

According to the filing, the initial rental term commences on January 1, 2027, and continues for ten years or until the parties enter into a power purchase agreement, whichever occurs first.

The filing also stated that early termination by Hatchbo requires 30 days’ notice, no ongoing default, and payment of 50% of the remaining rental fees.

Separately, New York-based financial services company Voya Financial Inc. (NYSE:VOYA) filed an SEC filing disclosing a 5.2% stake in Solaris Energy Infrastructure, holding 2.54 million shares.

Trading Metrics, Technical Analysis

Solaris Energy Infrastructure has a relative strength index (RSI) of 48.33.

The Texas-based proprietary power generation and distribution solutions company has a market capitalization of $3.52 billion, with a 52-week high of $59.80 and a 52-week low of $14.27.

SEI has gained 88.74% over the past 12 months.

The stock is positioned approximately 81.7% above its 52-week low.

SEI’s long-term trend and strong positioning suggest continued upside potential.

With a strong Momentum in the 95th percentile, Benzinga’s Edge Stock Rankings indicate that SEI has a positive price trend across all time frames.

Photo Courtesy: Xharites on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments