Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong said Thursday that the company’s karaoke-style advertisement during Super Bowl LX was a deliberate bid to draw people’s attention in a crowded market.

Armstrong Defends Ad Choice

In an X post, Armstrong called the Super Bowl an “overwhelming” event where even getting noticed could be challenging due to fierce competition for viewers’ eyeballs.

“The first step is even being noticed. Only then have you bought the right to get them interested in the next step: crypto,” Armstrong said, in response to criticism that the advertisement missed educating viewers about cryptocurrency.

The cryptocurrency mogul said Coinbase is brainstorming on formats for future commercials and invited the community to share their ideas.

A Flop Show After The 2022 Hit

Coinbase dropped a 60-second ad mimicking a karaoke screen, with scrolling lyrics and beats from Backstreet Boys’ 1997 hit “Everybody.”

However, the idea failed to connect with viewers, trending as the lowest-rated advertisement on USA Today’s Ad Meter the morning after the marquee sporting event.

This was in stark contrast to the hit Super Bowl floating QR code advertisement the company aired in 2022.

The commercial featured a bouncing QR code, linked with the company’s “Less talk, more Bitcoin” campaign. The overwhelming response caused Coinbase’s application to crash. The firm reportedly spent $14 million on the commercial

Coinbase’s Q4 Earnings, Outage

Coinbase reported fourth-quarter total revenue of $1.78 billion, missing analyst expectations, while its earnings of 66 cents per share beat consensus estimates.

In other developments, the cryptocurrency platform experienced a brief downtime that blocked user trading. The Coinbase Support team announced later that the issue had been resolved.

Zcash (CRYPTO: ZEC) jumped 22% in the last 24 hours, and over 40% in a week.

Price Action: Coinbase shares rose 0.87% in after-hours trading after closing 7.90% lower at $141.09 during Tuesday’s trading hours, according to Benzinga Pro. Year-to-date, the stock has plunged 37%.

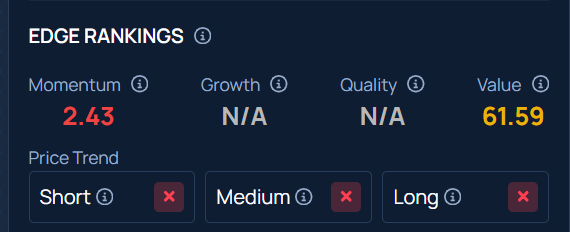

COIN stock maintains a weaker price trend in the short, medium, and long term, with an average Value ranking, according to Benzinga’s Edge Stock Rankings.

Image via Shutterstock By Thrive Studios ID

Recent Comments