GFL Environmental Inc (NYSE:GFL) reported upbeat earnings for the fourth quarter on Wednesday.

The company posted quarterly earnings of 26 cents per share which beat the analyst consensus estimate of 14 cents per share. The company reported quarterly sales of $1.209 billion which beat the analyst consensus estimate of $1.190 billion.

GFL Environmental said it sees FY2026 sales of $7.000 billion to $7.140 billion, versus estimates of $7.070 billion.

“Our more than 15,000 employees delivered another year of results that exceeded our expectations,” said Patrick Dovigi, Founder and Chief Executive Officer of GFL.”

GFL Environmental shares fell 5.7% to trade at $41.51 on Thursday.

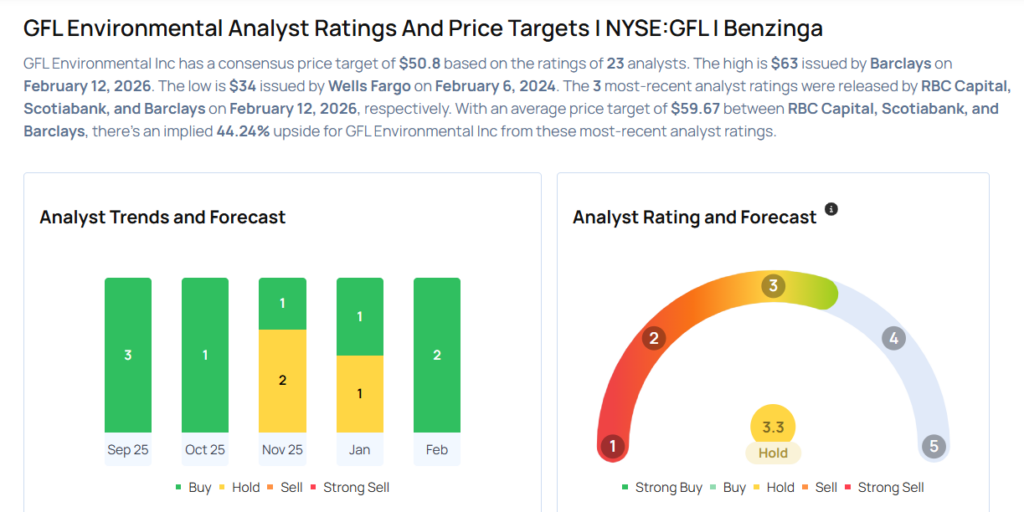

These analysts made changes to their price targets on GFL Environmental following earnings announcement.

- Barclays analyst William Grippin maintained GFL Environmental with an Overweight rating and raised the price target from $62 to $63.

- Scotiabank analyst Konark Gupta maintained the stock with a Sector Outperform and lowered the price target from $57 to $56.

- RBC Capital analyst Sabahat Khan maintained GFL Environmental with an Outperform rating and raised the price target from $59 to $60.

Considering buying GFL stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments