Rivian Automotive Inc (NASDAQ:RIVN) shares are trading lower Thursday morning as investors position ahead of the electric-vehicle maker’s fourth-quarter earnings report, due after the closing bell. Here’s what investors should be watching closely.

- RIvian stock is down Thursday. What’s ahead for RIVN stock?

Q4 Expectations: Smaller Per-Share Loss, Stronger Sales

Wall Street is looking for Rivian to post a fourth-quarter loss of 46 cents per share, narrowing from a loss of 81 cents a year earlier. On the top line, consensus calls for revenue of about $1.73 billion, up from roughly $1.26 billion in the prior-year quarter.

The estimates suggest analysts expect Rivian’s production ramp and cost-cutting efforts to keep improving even as overall EV demand cools.

Looking Back At Recent Momentum

In the third quarter, Rivian delivered strong year-over-year growth, generating about $1.56 billion in revenue and its first consolidated gross profit of roughly $24 million, while trimming its per-share loss. Management also kept its next-generation R2 SUV on track for a first-half 2026 launch, moves that helped the stock rebound from 2025 lows.

The company has since agreed to pay $250 million to settle a lawsuit tied to its 2021 IPO, while advancing custom silicon, autonomy and a major software partnership with Volkswagen—steps that clear legal overhang and highlight its tech ambitions.

Upbeat early reviews of the R2 from auto influencers and bullish commentary from investor Ross Gerber have further stoked optimism around the 2026 lineup.

What To Listen For After The Bell

On tonight’s call, traders will focus on Rivian’s 2026 production outlook, margin trajectory and cash burn, plus fresh detail on the mass-market R2 crossover and any additional variants.

Commentary on demand trends, pricing and the competitive landscape versus Tesla and legacy automakers could determine RIVN’s next move.

Rivian’s Business Model

Rivian is a battery electric vehicle automaker that sells its vehicles in the US and Canada. The company also develops electronic control units and related software for autos in a joint venture with Volkswagen. Rivian has multiple vehicles in its fleet, which include a luxury truck and full-size SUV and a delivery van. Rivian is also developing autonomous driving software to be used in its vehicles.

The recent reviews of the R2 model are significant as they may influence consumer interest and sales, especially as Rivian competes in a market dominated by established players like Tesla.

Rivian Analyst Ratings And Targets

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $16.25. Recent analyst moves include:

- UBS: Downgraded to Sell (Raises Target to $15.00) (Jan. 14)

- Wolfe Research: Downgraded to Underperform (Jan. 12)

- Piper Sandler: Neutral (Raises Target to $20.00) (Jan. 8)

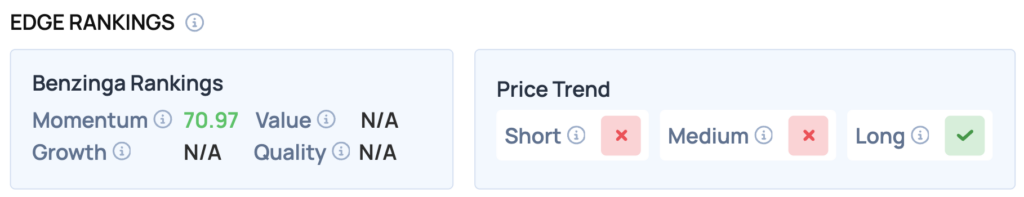

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Rivian Automotive, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Strong (Score: 70.97) — Stock is outperforming the broader market.

The Verdict: Rivian Automotive’s Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the broader market. Investors should monitor upcoming earnings and analyst sentiment as the company continues to develop its product lineup and navigate competitive pressures.

RIVN Shares Fall Thursday

RIVN Price Action: Rivian Automotive shares were down 3.59% at $14.24 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments