The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Papa John’s International Inc (NASDAQ:PZZA)

- Papa John’s International is scheduled to release its fourth quarter financial results before the opening bell on Thursday, Feb. 26. The company’s stock fell around 11% over the past month and has a 52-week low of $30.16.

- RSI Value: 29.8

- PZZA Price Action: Shares of Papa John’s fell 2.3% to close at $34.01 on Wednesday.

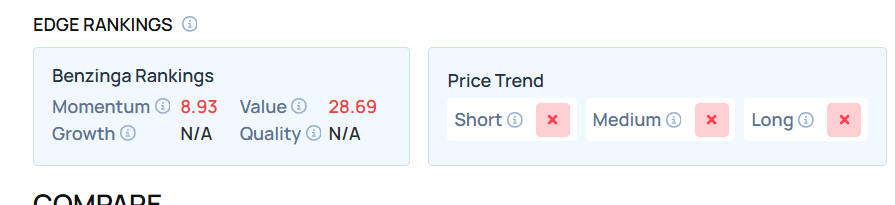

- Edge Stock Ratings: 8.93 Momentum score with Value at 28.69.

Wayfair Inc (NYSE:W)

- On Feb. 5, Affirm and Wayfair announced the expansion of their partnership to the UK and Canada. “Home is deeply personal, and we want every part of the shopping experience — including how customers pay — to reflect that,” said Curtis Crawford, head of fintech and loyalty at Wayfair. “Since first partnering with Affirm nearly a decade ago, we’ve seen how much our customers value having flexible, transparent payment options. Expanding Affirm to the UK and Canada means more shoppers can invest in their homes in a way that works for them, with no hidden fees or surprises.” The company’s stock fell around 23% over the past month and has a 52-week low of $20.41.

- RSI Value: 29.7

- W Price Action: Shares of Wayfair fell 2.2% to close at $88.07 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in W stock.

America’s CAR-MART Inc (NASDAQ:CRMT)

- On Jan. 13, America’s Car-Mart said it has completed the second phase of its SG&A cost-cutting plan, consolidating 13 underperforming locations into higher-performing nearby dealerships. The company’s stock fell around 19% over the past month and has a 52-week low of $17.80.

- RSI Value: 29.6

- CRMT Price Action: Shares of America’s CAR-MART fell 4.7% to close at $22.31 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in CRMT shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Photo via Shutterstock

Recent Comments