Astera Labs Inc (NASDAQ:ALAB) shares are falling Wednesday morning after the company released its fourth-quarter earnings report following Tuesday’s closing bell. Here’s what investors need to know.

- Astera Labs stock is showing notable weakness. Why is ALAB stock dropping?

Astera Labs Tops Estimates, Guides Higher

Astera Labs reported fourth-quarter revenue of $270.58 million, exceeding analyst expectations of $249.47 million, marking a 17% increase quarter-over-quarter. The company also posted adjusted earnings of 58 cents per share, surpassing estimates of 51 cents per share, indicating strong financial performance.

In addition, Astera Labs announced a transition in its leadership, with Mike Tate stepping down as CFO to become a strategic advisor, while Desmond Lynch will take over as CFO effective March 2.

The company anticipates first-quarter revenue between $286 million and $297 million, which is above the estimated $259.3 million, reflecting robust customer momentum and growth opportunities.

Is Profit Taking Pressuring ALAB Shares?

Investors are potentially locking in profits after a 61% run over the past year. The stock had rallied sharply into the print, raising expectations beyond the headline beats on revenue and earnings.

The CFO transition could be creating uncertainty as well. Elevated expectations, valuation concerns and technical selling are likely outweighing the solid quarterly results.

Meanwhile, Citigroup maintained its Buy rating on Wednesday but cut its price target from $275 to $250.

Momentum Slows After Strong Run

Shares have increased 61.80% over the past 12 months, indicating a strong long-term trend, but the current price action suggests a shift in sentiment. The stock is trading 11.6% below its 20-day simple moving average (SMA) and 13.5% below its 100-day SMA, indicating a struggle to maintain upward momentum.

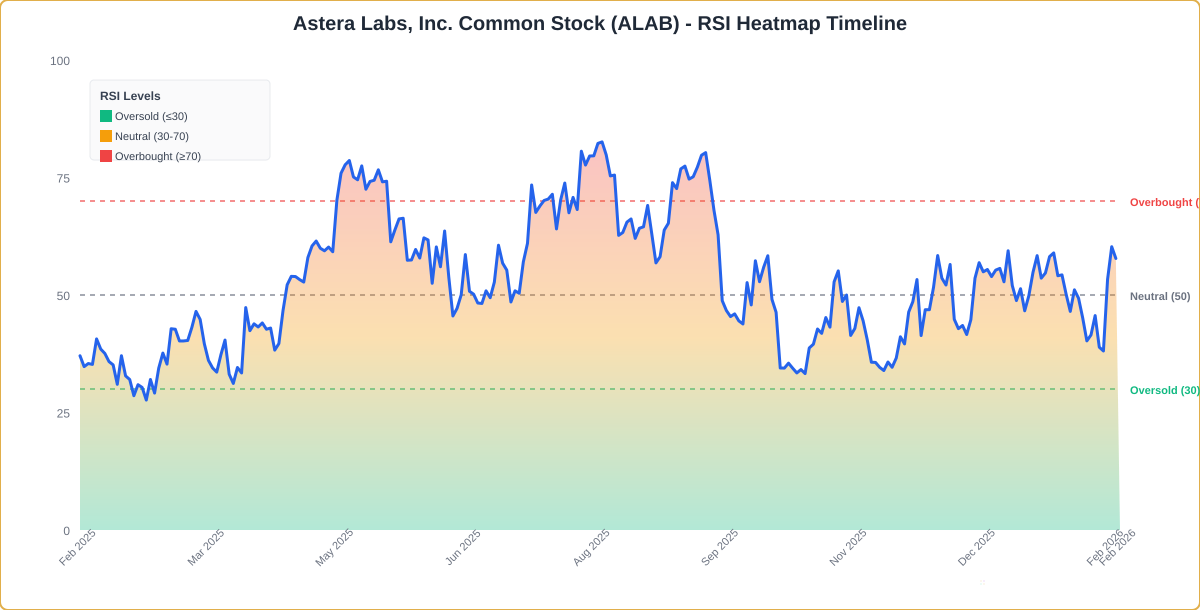

The RSI is at 58.08, which is considered neutral territory, while the MACD is above its signal line, indicating bullish momentum.

the combination of a neutral RSI and bullish MACD suggests mixed momentum, indicating that traders should remain cautious.

- Key Resistance: $161.00

- Key Support: $140.00

Astera Labs Drives AI Connectivity

Astera Labs designs and delivers semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates semiconductor technology, microcontrollers, sensors and software to enhance performance, scalability and data management.

The company’s recent earnings report highlights its strong position in the semiconductor market, particularly as it continues to innovate and expand its product offerings. This is crucial as the demand for connectivity solutions in AI-driven platforms grows.

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Astera Labs, highlighting its strengths and weaknesses compared to the broader market:

- Value: 2.92 — The stock is trading at a premium relative to peers.

- Momentum: 88.61 — Stock is outperforming the broader market.

The Verdict: Astera Labs’ Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the market. However, the low value score suggests that it may be trading at a premium, which could raise concerns for value-focused investors.

ALAB Shares Fall Sharply Wednesday

ALAB Price Action: Astera Labs shares were down 19.81% at $146.64 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments