Lucid Group Inc (NASDAQ:LCID) shares are tumbling on Wednesday as the company faces headwinds despite recently securing a significant victory in real-world testing. Here’s what investors need to know.

- Lucid Group shares are sliding. Why is LCID stock falling?

Lucid Highlights Next-Gen EV Strategy

Lucid’s recent performance highlights its technological advancements, with the Lucid Air Grand Touring achieving the longest range in the 2026 Norges Automobil-Forbund Winter Test, covering 520 kilometers on a single charge.

Despite this achievement, shares are under pressure, with analysts maintaining a cautious outlook: Cantor Fitzgerald recently reiterated a Neutral rating while keeping a price target of $21, suggesting over 100% upside from current levels.

Additionally, the company is set to host an Investor Day on March 12, where it plans to outline its strategic roadmap, including a preview of its next-generation vehicle architecture.

This event is critical as Lucid aims to solidify its position in the competitive electric vehicle market, especially with backing from the Saudi Public Investment Fund.

LCID Shares Struggle Below Key Averages

The stock’s technical indicators reveal a bearish trend, with the 20-day simple moving average (SMA) at $10.71 and the 50-day SMA at $11.49, indicating that the stock is trading 5.2% below its 20-day SMA and 11.7% below its 50-day SMA. This positioning suggests a struggle to regain upward momentum.

Shares have decreased 62.25% over the past 12 months, showing a significant long-term downtrend. Currently, the stock is positioned closer to its 52-week low of $9.50 than its high of $35.90, highlighting ongoing challenges in regaining investor confidence.

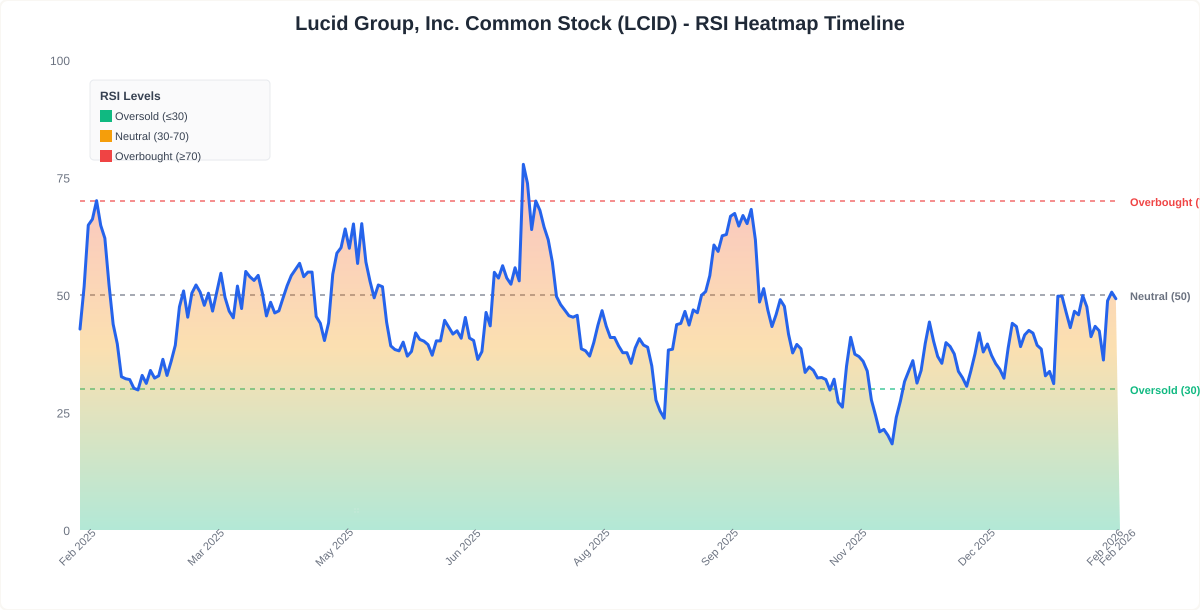

The RSI is at 49.96, indicating neutral momentum, while the MACD is above its signal line, suggesting some bullish signals.

This combination points to a mixed outlook, with potential for upward movement if market conditions improve. The combination of neutral RSI and bullish MACD suggests mixed momentum, indicating that while there may be some underlying strength, the stock is not yet in a clear upward trend.

- Key Resistance: $12.00

- Key Support: $9.50

Investor Day Critical For Lucid

Lucid Group is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It offers its own geographically distributed retail and service locations and through direct-to-consumer online and retail sales. It also boasts a product roadmap of future vehicle programs and technologies.

The company’s recent achievements in vehicle performance, particularly in extreme winter conditions, reinforce its technological capabilities. However, the upcoming Investor Day will be crucial for Lucid to communicate its future strategies and reassure investors about its growth trajectory.

Lucid Earnings Report Due February

The countdown is on: Lucid Group is set to report earnings on Feb. 24.

- EPS Estimate: $-2.57 (Down from $-2.20 YoY)

- Revenue Estimate: $468.45 million (Up from $234.47 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Hold Rating with an average price target of $25.70. Recent analyst moves include:

- Morgan Stanley: Downgraded to Underweight (Lowers Target to $10.00) (Dec. 8, 2025)

- Stifel: Hold (Lowers Target to $17.00) (Nov. 17, 2025)

- Cantor Fitzgerald: Neutral (Lowers Target to $21.00) (Nov. 6, 2025)

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Lucid Group, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Weak (Score: 1.51) — Stock is underperforming the broader market.

The Verdict: Lucid Group’s Benzinga Edge signal reveals a challenging position as the stock struggles with momentum. While the recent backing from the PIF provides some stability, the low momentum score indicates that investors should proceed with caution.

Lucid Stock Slides Wednesday

LCID Price Action: Lucid Group shares were down 7.23% at $10.14 at the time of publication on Wednesday, according to Benzinga Pro data.

Recent Comments