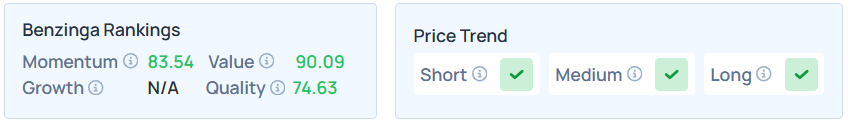

Ford Motor Co. (NYSE:F) has officially broken into the top 10% of stocks for relative worth, as its Benzinga Edge’s value score climbed from 89.53 to a formidable 90.09 this week.

Record Revenue vs. Special Item Headwinds

This percentile-ranked jump comes as investors digest a massive $187.3 billion full-year revenue milestone, the company’s fifth consecutive year of top-line growth.

Despite a volatile environment, the undervalued narrative is gaining steam as Ford’s market price is weighed against its fundamental strength.

Despite the massive revenue, thecarmaker reported a GAAP net loss of $8.2 billion for the year, largely due to $17.4 billion in pre-tax special items.

These charges included significant EV strategy shifts, such as the $10.7 billion impairment for Model e asset write-downs and the cancellation of an all-electric three-row SUV. Excluding these one-time hits, Ford’s adjusted EBIT stood at a robust $6.8 billion.

Benzinga Edge’s Stock Rankings show that Ford had a stronger price trend over the short, long, and medium terms, with a solid quality ranking.

Segments Drive The Value Proposition

The company’s value ranking is underpinned by the massive earning power of Ford Pro, which generated more than $66 billion in revenue with double-digit margins. In the U.S., Ford Pro holds a dominant 42% market share in classes 1-7.

Meanwhile, the Ford Blue segment delivered $3 billion in EBIT, supported by record sales of the Bronco and the Explorer’s status as the top-selling three-row SUV in the U.S. Ford Credit also bolstered the bottom line, with EBT rising 55% to $2.6 billion.

Disciplined Outlook For 2026

Management is signaling a “stronger future” through aggressive capital discipline. Ford’s 2026 outlook projects an adjusted EBIT between $8 billion and $10 billion, with adjusted free cash flow expected to reach $5 billion to $6 billion.

A significant $1.5 billion is earmarked to ramp up “Ford Energy,” a new startup focused on battery storage and grid stability.

Ford Mirrors S&P 500’s YTD Performance

Shares of Ford have risen by 1.72% year-to-date, while the S&P 500 was up 1.22% in the same period. The stock was also up 21.81% over the last six months and 47.34% over the year.

On Tuesday, the stock closed 0.15% lower at $13.57 per share. It was up 1.69% in premarket trading on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments