Despite the ongoing global memory chip shortage, Apple Inc. (NASDAQ:AAPL) stock could see a rise, propelled by the imminent launch of Apple Intelligence, said a Bernstein analyst.

Senior Technology analyst, Mark Newman, suggested that the escalating memory costs, which could potentially reduce Apple’s margins by 1.5 percentage points by the end of the year, should not overshadow the potential of the upcoming Apple Intelligence launch, MarketWatch reported on Tuesday.

The analyst said investors focusing on rising memory chip costs are overlooking the broader outlook for Apple.

He expects component costs for the next iPhone to rise by about 15% this year, resulting in a 12% surge in the overall average selling price. Despite these factors, Newman has raised his price target on Apple’s stock to $340 from $325, asserting that “the bigger story will be Apple Intelligence / Siri 2.0 coming sometime this year.”

Newman emphasized that the collaboration with Google (NASDAQ:GOOGL) (NASDAQ:GOOG) that merges Apple’s on-device foundational models with Gemini artificial-intelligence models will be the key driver for the stock in 2026.

Tim Cook Dismisses Memory Cost Impact

The global memory chip shortage is not easing but rather tightening further, creating a pricing environment that could push earnings and margins towards cycle highs for players in this sector, according to Goldman Sachs analyst Giuni Lee.

During last month’s earnings call, CEO Tim Cook said memory costs would not materially impact the current quarter but offered no guidance beyond that. The company also declined to disclose any potential effect on iPhone pricing. This comes at a time when Apple has just had its best iPhone sales quarter, expanding its market share to 69% from 65% in the previous year.

Earlier this month, a report suggested that the company is prioritizing production and shipments of its high-end iPhone models for 2026, postponing the standard version amid memory chain constraints.

On Apple Intelligence, DA Davidson analyst Gil Luria‘s view resonates with Newman. Luria said Apple Intelligence could become a “larger factor” in consumer purchasing decisions, noting that Cook highlighted that most eligible iPhones are actively using the feature and pointed to updates introduced since its launch.

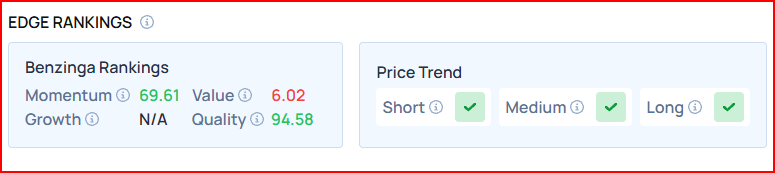

Benzinga’s Edge Rankings place Apple in the 94th percentile for quality and the 69th percentile for momentum, reflecting its mixed performance. Benzinga’s screener allows you to compare Apple’s performance with its peers.

Price Action: Over the past year, Apple stock climbed 17.65%, as per data from Benzinga Pro. On Tuesday, the stock fell 0.34% to close at $273.68.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments