The New York Times Co. (NYSE:NYT) is leveraging a “carrot” approach to monetization, using premium Family Plans to drive growth while avoiding the aggressive password-sharing crackdowns that recently triggered public backlash against Netflix Inc. (NASDAQ:NFLX).

The Carrot Vs. The Stick

While Netflix opted for a “stick” approach—systematically blocking unauthorized users and requiring device verification—The New York Times is focusing on voluntary incentives.

During the company’s fourth-quarter 2025 earnings call, CEO Meredith Kopit Levien described the “Family Plan” as a strategic alternative to forced lockouts.

“That’s almost like the carrot version of password sharing,” Levien noted, explaining that the plan allows subscribers to bring others into the ecosystem under a premium-priced model.

This strategy is designed to “induce people to have a favorable view of subscriptions” rather than “nickeling and diming” the audience.

Driving Engagement And Revenue

The NYT model treats sharing as a tool for retention rather than a loss of revenue. Levien highlighted that the Family Plan is “priced at a premium” and is “additive out of the gate to revenue.” Beyond immediate financials, the goal is deep-seated loyalty.

“The family plan is yet another way to improve engagement of our subscribers and ultimately retention,” Levien stated. She added, “If we can get you to do it with the people you love and interact with, that is also true.”

Record Growth Amidst Market Shifts

This anti-Netflix strategy appears to be paying off. The NYT reported that total digital revenues “surpassed $2 billion for the first time” in 2025. The company added 450,000 net new digital subscribers in the fourth quarter alone, bringing its total to 12.8 million.

While the company is wary of the Netflix misstep, it has not completely closed the door on stricter measures. “Our version for now… is the family plan,” Levien said. “But I don’t rule out something else down the road.”

NYT Mirrors S&P 500’s YTD Performance

Shares of NYT have risen by 1.29% year-to-date, while the S&P 500 was up 1.22% in the same period. The stock was also up 22.76% over the last six months and 42.70% over the year.

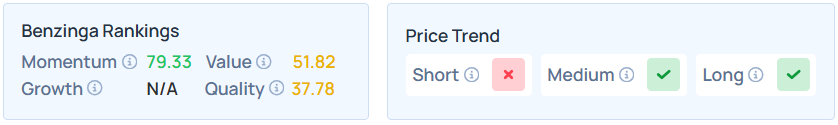

On Tuesday, the stock closed 3% higher at $70.72 per share. Benzinga Edge’s Stock Rankings showed that NYT had a weaker price trend in the short-term but a stronger trend in the long and medium terms, with a moderate quality ranking.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tada Images via Shutterstock

Recent Comments