The U.S. Defense Department is doing something it doesn’t normally do: taking equity stakes in mining companies instead of just signing supply contracts.

The reason is gallium, a little-known metal that’s critical for military radar systems, satellites, and 5G infrastructure. China controls 98% of global supply and has already imposed export restrictions. Prices have tripled in two years, hitting a record $1,572 per kilogram in January.

Now the Pentagon is committing $1.9 billion to build domestic production capacity, with projects in Tennessee, Louisiana, and Australia set to come online between 2026 and 2030. For retail investors, there’s one publicly traded stock that offers direct exposure: Alcoa Corp (NYSE:AA).

But the trade comes with a timer. By 2028, new supply could flood a market so small that one expert warns “it would crash.” Here’s what investors need to know about the gallium story and whether the opportunity window is still open.

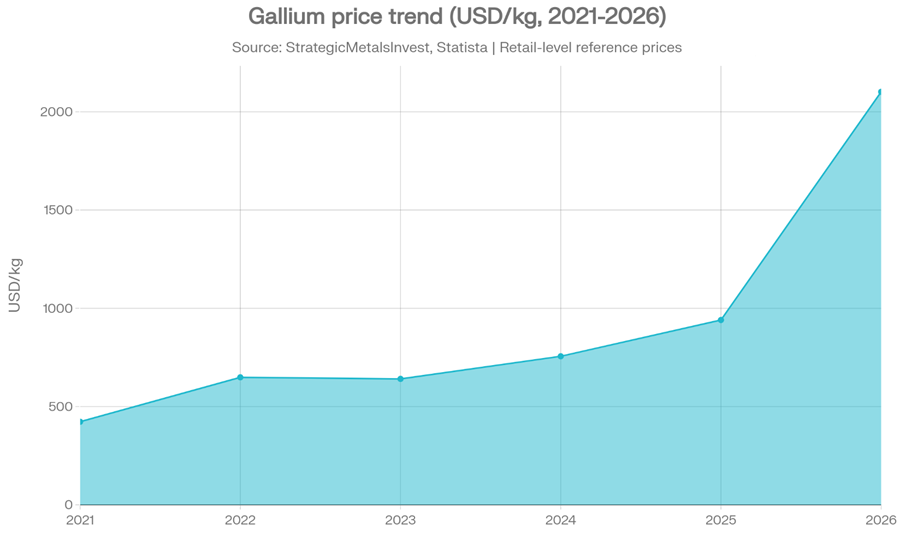

Gallium spot prices per kilogram, 2021–2026. All data sourced from StrategicMetalsInvest’s historical gallium price table and Statista’s January 2024 global reference price.

What Makes Gallium Worth Billions

Gallium doesn’t get mined on its own. It hides in bauxite ore, the same stuff used to make aluminum. When refineries process bauxite into alumina, gallium shows up in the waste, in what the industry calls “red mud.”

For decades, this was waste thrown away. Now it’s worth money.

Mix gallium with nitrogen and arsenic, and you get substrates for semiconductors that handle heat and electricity better than silicon. Those chips power 5G towers, electric vehicle chargers, military radars, and satellites. Without gallium, none of those things work.

China figured this out early. While building massive aluminum capacity over the past twenty years, Chinese companies added gallium extraction to their refineries. They spent almost nothing on raw materials since gallium was already there in the waste stream. Just add the extraction equipment.

That’s how China ended up controlling nearly all global production. Not because they’re better at mining. Because they built the infrastructure when nobody else cared.

Now everybody cares. In 2023, China imposed export controls. In 2024, they banned gallium shipments to the US entirely. The ban got lifted, but China could flip that switch again anytime.

Prices outside China hit a record $1,722 per kilogram in January 2026. That’s triple what they were two years ago. And it keeps surging.

The Pentagon’s Unusual Move

The Defense Department did something worth noticing in response. Instead of just buying gallium from whoever could supply it, they started taking equity stakes in mining companies.

$1.9 billion went to Korea Zinc for a Tennessee smelter that will extract gallium from zinc ore. $150 million went to Atlantic Alumina in Louisiana to pull gallium from red mud stockpiles. More funding went to Alcoa for a plant in Western Australia.

This isn’t how the Pentagon normally operates. In general, the government signs contracts. Buy this many tons, deliver by this date, here’s your money.

Taking equity stakes means the government becomes a part owner. They’re making a bet these companies will succeed. That’s venture capital behavior, not typical military procurement.

You can read this two ways. Either it signals genuine concern about supply security. Or it shows how far the government will go when “national security” enters the conversation, regardless of whether the economics make sense.

The Stock That’s Actually Tradeable

Most of these projects involve private companies or foreign firms. Korea Zinc trades in Seoul. Atlantic Alumina isn’t public at all.

Alcoa (NYSE:AA) is the exception. It trades on the Nasdaq with a market cap around $15.6 billion. The stock has climbed 62% over the past two years, though that has more to do with aluminum prices and tariff discussions than gallium.

Alcoa runs a big alumina refinery in Wagerup, Western Australia. They’ve been processing bauxite there since the 1980s. The gallium was always in the ore. They just never bothered extracting it.

Now they’re building equipment to do exactly that. The plant should produce about 100 metric tons of gallium per year starting late 2026. That’s 10% of current global demand.

At current prices of $1,700 per kilogram, 100 tons equals $170 million in annual revenue. For a company Alcoa’s size, that’s only 1.2% of total sales.

But gallium comes from waste. The raw material is essentially free. Alcoa already owns the bauxite and already processes it into alumina. Pulling gallium out costs money for equipment and energy, but margins could reach 70-80% once the plant runs at capacity.

If gallium prices stay elevated, that $170 million in revenue could translate to $100 million or more in profit. For a company that earned around $1.2 billion last year, that’s noticeable.

Alcoa’s CEO mentioned they could add gallium extraction to other refineries if the economics work. Whether that happens depends entirely on where prices go from here.

The Problem They Don’t Want to Talk About

Here’s where the trade gets tricky. Three big projects are coming online over the next four years:

- Alcoa in Australia: 100 tons per year, starting late 2026

- Atlantic Alumina in Louisiana: 50 tons per year, probably 2027-2028

- Korea Zinc in Tennessee: 54 tons per year, starting 2030

Add those up. That’s 204 tons of new supply hitting a market that produced 760 tons total in 2024.

You’re looking at a 27% increase in global capacity. Demand is only expected to grow 24% by 2030.

The math doesn’t work.

Ian Lange, an economics professor at the Colorado School of Mines, put it bluntly when asked about all this new production: “The market is so small it would crash.”

We’ve seen this movie before. In 2010, China restricted rare earth element exports. Prices went crazy. Western countries rushed to build new mines. By 2015, oversupply killed the rally. Prices crashed 70-90%. Most of those new mines went bankrupt.

Gallium is even smaller than the rare earth market. Add too much supply, and prices collapse fast.

China’s Counterpunch

There’s another risk. China can produce gallium at half the cost of American companies.

US facilities need gallium prices around $800-1,000 per kilogram to break even. China does it for under $500. They’ve got cheap energy, cheap labor, and aluminum overcapacity that makes the raw material essentially free.

If Beijing wants to kill these new American projects, they just flood the market. Sell gallium at $600 per kilogram for two years. American plants go underwater. Projects get shelved. Workers get laid off.

Then China raises prices again once the competition is dead.

This is exactly what happened with solar panels. China deliberately oversupplied the market in 2012-2015. American solar manufacturers went bust. Same pattern with steel, rare earths, and plenty of other industries.

January’s prices of $1,722 per kilogram reflect panic, not normal market conditions. Once new supply comes online and geopolitical tensions ease, expect those prices to fall hard.

Two Ways to Think About This

You can build a case either direction.

The bull argument runs like this: Geopolitical tensions with China aren’t easing. Military demand for gallium keeps growing. New supply won’t hit until late 2026 at earliest, and most projects won’t start until 2027-2030. Prices could stay elevated or go higher before any of that new capacity matters. Alcoa’s stock might run from current levels around $42 to somewhere in the $55-60 range if the gallium story gets more attention from investors.

The opportunity window probably closes by late 2027. That gives you 18-24 months to play it if you think the setup is real.

The bear argument says you’re chasing a price spike that’s already played out. Gallium has tripled in two years. The easy money got made. Now you’re buying at record prices right before 27% more supply floods a tiny market. China can dump product anytime they want and kill American competitors before the plants even finish ramping up. This looks like the rare earth boom of 2010-2011, which ended with a 70-90% price crash by 2015.

Even if prices don’t crash immediately, they probably drift lower once fear subsides and new capacity starts producing. By 2028, you could own stock in a company making gallium nobody wants at prices that don’t cover costs.

Both cases have merit. The trade depends on timing more than anything else.

What the Numbers Tell You

Alcoa now trades around 62 dollars a share. At 100 tons of gallium production with 75% margins, you’re looking at roughly 112 million dollars in annual profit from this one plant. That’s on the order of 10% of Alcoa’s current annual net income, assuming its latest 2025 profit run rate holds. Not huge, but enough to move the stock if gallium stays in the headlines.

The stock has already climbed roughly 130% over the past two years, so some of this upside is arguably priced in. But most investors still don’t know what gallium is or why it matters. When Wagerup starts producing later this year, a fresh wave of headlines around ‘gallium’ and ‘China risk’ could still be enough to drive another leg higher.

Just remember: you’re not investing in Alcoa’s aluminum business. You’re trading a spike in gallium prices driven by geopolitics and supply fears. Those things don’t last forever.

What Could Go Wrong

Three things can kill this trade:

First, China opens the export taps. They decide flooding the market and killing American competition is worth more than high prices today. Gallium crashes to $700-800 per kilogram. American projects become unprofitable.

Second, US projects get delayed. Permitting issues, construction problems, equipment failures. This is mining and refining. Things go wrong all the time. If Alcoa’s plant doesn’t start until 2028 instead of late 2026, you’re stuck waiting while the opportunity window closes.

Third, demand disappoints. Maybe 5G buildout slows down. Maybe electric vehicle adoption stalls. Maybe new chip designs need less gallium. If demand doesn’t grow 24% like everyone expects, even modest new supply creates a glut.

Any of those scenarios turns this trade into a loser. You need everything to go right, and you need to exit before it goes wrong.

What the Pentagon’s Bet Tells You

The government throwing around $1.9 billion equity checks means they’ve run numbers and seen classified intelligence about Chinese production capacity and export controls.

But government money doesn’t always mean good economics. The Pentagon’s job is securing military supply chains, not generating returns for shareholders. They’ll overpay if that’s what it takes to guarantee domestic production.

Following their lead might work. Or you might be subsidizing a project that only makes sense if you don’t care about profit margins.

The Defense Department’s involvement proves gallium matters for national security. Whether that translates to a good stock trade is another question.

What This Means for Your Money

Gallium presents an odd situation. A genuine supply problem. Government backing. A tradeable stock in Alcoa. Clear risks from oversupply and Chinese competition.

The bull case depends on fear and scarcity lasting through 2027. The bear case points to basic economics: too much new supply hitting too small a market.

Alcoa’s Wagerup plant could add $100 million in annual profit if gallium holds at current prices. That’s roughly 8-10% of what the company earns now. Enough to matter, but not enough to transform the business.

The stock has already run 130% in two years, so some of this story is priced in. How much is hard to say.

If you think geopolitical tensions stay hot and supply stays tight for another 18 months, there’s probably money to be made. If you think markets tend to overshoot on fear and oversupply is coming anyway, you’d wait or skip it entirely.

Either way, this isn’t a buy-and-forget situation. The market is small. The dynamics can shift fast. And China holds most of the cards when it comes to pricing.

Worth watching, at minimum. Whether it’s worth buying depends on your view of how the next two years play out.

Disclaimer: This analysis is based on publicly available information including company filings, Department of Defense announcements, and commodities market data from Argus Media. Companies mentioned include Alcoa, Korea Zinc (KRX:010130), and private firms Atlantic Alumina. All figures are approximate and subject to change. Investors should conduct their own research before making investment decisions.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Recent Comments