Spotify Technology S.A. (NYSE:SPOT) will release earnings for its fourth quarter before the opening bell on Tuesday, Feb. 10.

Analysts expect the Luxembourg-based company to report quarterly earnings of $2.85 per share. That’s up from $1.76 per share in the year-ago period. The consensus estimate for Spotify’s quarterly revenue is $4.52 billion (it reported $4.24 billion last year), according to Benzinga Pro.

On Jan. 15, the music streaming giant said it will increase the price of its Premium subscription in the U.S., Estonia and Latvia to $12.99 per month, up from $11.99, with the change taking effect on February billing cycles.

Shares of Spotify fell 1.8% to close at $414.84 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

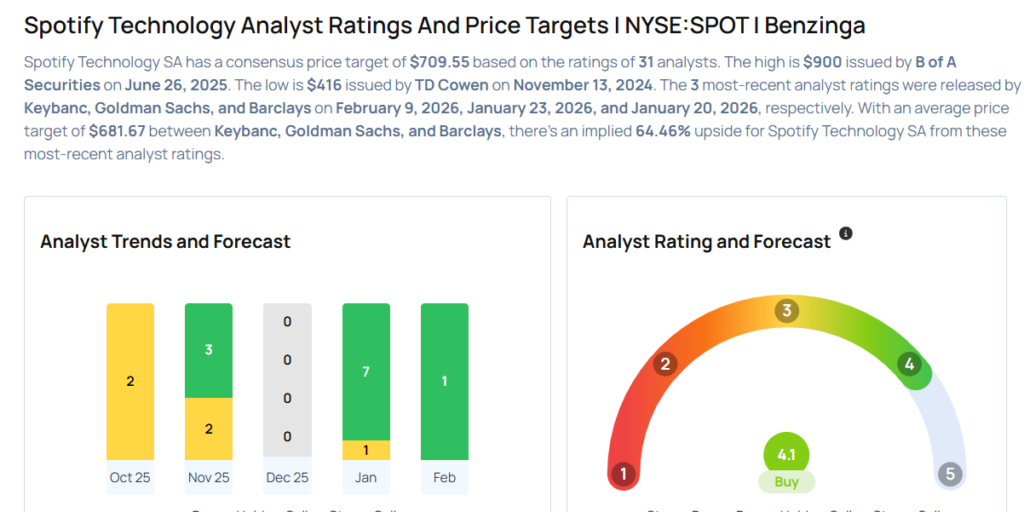

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Keybanc analyst Justin Patterson maintained an Overweight rating and cut the price target from $830 to $720 on Feb. 9, 2026. This analyst has an accuracy rate of 64%.

- Goldman Sachs analyst Eric Sheridan upgraded the stock from Neutral to Buy and lowered the price target from $735 to $700 on Jan. 23, 2026. This analyst has an accuracy rate of 76%.

- Barclays analyst Kanan Venkateshwar maintained an Overweight rating and slashed the price target from $700 to $625 on Jan. 20, 2026. This analyst has an accuracy rate of 55%.

- Benchmark analyst Mark Zgutowicz maintained a Buy rating and cut the price target from $860 to $760 on Jan. 16, 2026. This analyst has an accuracy rate of 53%.

- Wells Fargo analyst Steven Cahall maintained an Overweight rating and cut the price target from $750 to $710 on Jan. 13, 2026. This analyst has an accuracy rate of 64%

Considering buying SPOT stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments