Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong championed cryptocurrency and tokenization on Monday, emphasizing that they open up investment opportunities to billions.

‘A Great Equalizer’

In an X post, Armstrong argued that the two technologies would democratize wealth creation by providing a “level playing field” for people worldwide.

“Crypto and tokenization will be a great equalizer, giving billions a level playing field to pursue wealth creation,” the cryptocurrency mogul said.

Armstrong drew on psychologist Jordan Peterson’s view that we should prioritize “equality of opportunity” instead of “equality of outcomes.”

Asset Tokenization: The Future Of Finance?

There has been a sustained industry-wide shift toward asset tokenization. The total market for tokenized U.S. treasuries has swelled to $10.10 billion, according to RWA.xyz, with BlackRock’s (NYSE:BLK) fund, BUILDL, among the most popular.

The New York Stock Exchange, considered the world’s largest and most liquid equity exchange, announced last month that it would develop a platform for the trade and on-chain settlement of tokenized U.S.-listed stocks.

Moreover, stablecoins, widely seen as tokenized versions of fiat currencies such as the dollar, boast a total market capitalization of $314 billion as of this writing.

The Bottlenecks

However, the sector grapples with regulatory hurdles. Coinbase withdrew its support for the Senate Banking Committee’s crypto market structure bill over a clause that prohibited on-chain versions of stocks and other real-world assets.

Armstrong later urged Congress to ensure a “level playing field,” accusing banks and TradFi players of stifling competition.

Coinbase is set to report earnings for the fourth quarter of 2025 after the closing bell on Thursday.

Price Action: Coinbase shares fell 0.45% in after-hours trading after closing 1.29% higher at $167.25 during Monday’s regular trading hours, according to data from Benzinga Pro. Year-to-date, the stock has plunged 26%.

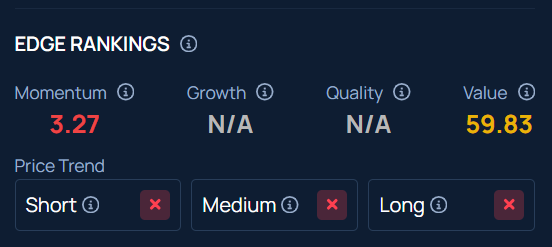

COIN stock maintains a weaker price trend in the short, medium, and long term, with a low Momentum ranking, according to Benzinga’s Edge Stock Rankings.

Image via Shutterstock By Thrive Studios ID

Recent Comments