Shares of Super Micro Computer Inc (NASDAQ:SMCI) are trading slightly lower Monday morning, giving back a portion of last week’s post-earnings rally as investors digested analyst rating updates and ongoing volatility in the high-flying AI server name. Here’s what investors need to know.

- Super Micro Computer stock is taking a hit today. What’s pressuring SMCI stock?

Earnings Beat Highlights Strong AI-Driven Demand

The move comes after Super Micro reported fiscal second-quarter results last week that topped Wall Street expectations. The company posted adjusted earnings of 69 cents per share on revenue of $12.68 billion, ahead of consensus estimates of 49 cents and $10.21 billion, respectively.

Management also guided third-quarter revenue to about $12.3 billion and forecast full-year sales of roughly $40 billion, both above analyst projections.

Analysts Maintain Bullish Ratings, Cut Targets

Despite the beat-and-raise quarter, several Wall Street firms trimmed their price targets while reiterating bullish views, a combination that appears to be fueling choppy trading.

Needham maintained a Buy rating but cut its target to $40 from $51, while Rosenblatt also kept a Buy and lowered its target to $50 from $55. Barclays likewise stayed positive on the name but reduced its target to $38 from $43.

Even after the target reductions, all three firms continue to see meaningful upside from current levels, with implied gains ranging from the mid-teens to more than 50%.

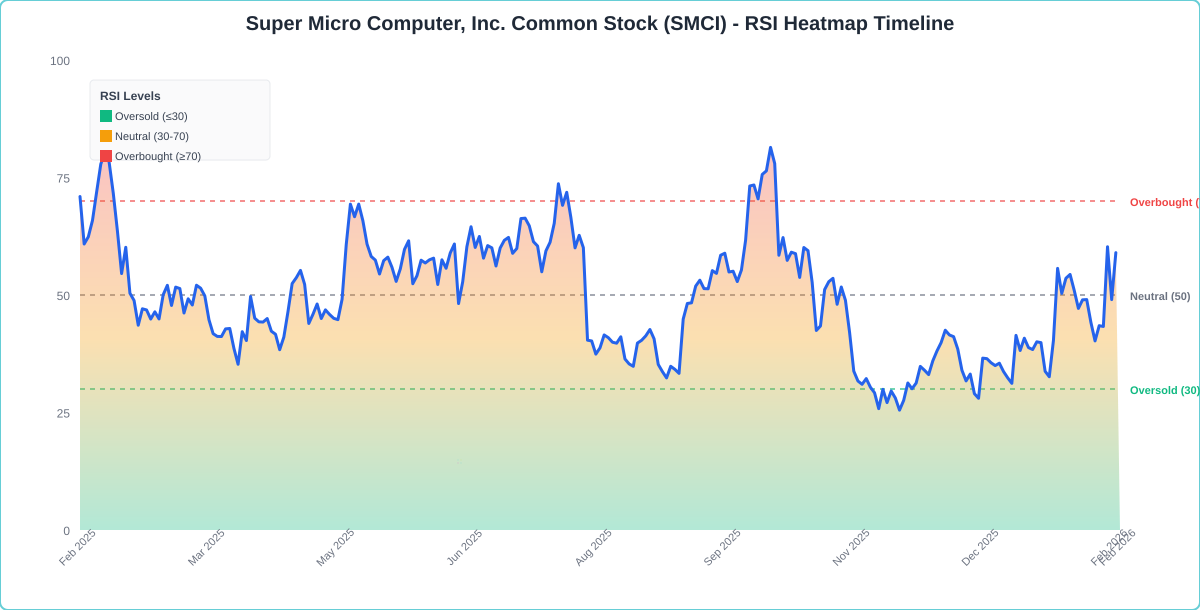

Mixed Technical Picture For SMCI

The stock is currently trading 7.4% above its 20-day simple moving average (SMA) but is 14.7% below its 100-day SMA, demonstrating a mixed technical picture.

Over the past 12 months, shares have decreased by 21.89%, and they are currently positioned closer to their 52-week lows than highs, indicating ongoing challenges.

The RSI is at 60.09, which is considered neutral territory, while the MACD is above its signal line, suggesting bullish momentum. However,

the combination of neutral RSI and bullish MACD indicates mixed momentum, reflecting uncertainty in the stock’s short-term trajectory.

- Key Resistance: $33.50

- Key Support: $29.00

SMCI Shares Fall Monday Morning

SMCI Price Action: Super Micro Computer shares were down 1.57% at $33.84 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments