Bitmine Immersion Technologies Inc (AMEX:BMNR) shares are little changed Monday morning as cryptocurrencies start the week under pressure. Ethereum is trading near $2,030 and Bitcoin fell below $69,000 after nearly $400 million in 24-hour liquidations and fresh outflows from spot Ethereum ETFs.

Here’s what investors need to know.

- BitMine Immersion stock is showing downward pressure. Where are BMNR shares going?

Massive Ethereum Treasury Leverages Bitmine’s Balance Sheet

The selloff hits Bitmine harder than most crypto-related stocks because the Las Vegas–based company is effectively a listed Ethereum treasury.

Per a Monday press release, as of Feb. 8, Bitmine held 4.326 million ETH, about 3.6% of supply, plus small Bitcoin and venture stakes and $595 million of cash, for about $10 billion of crypto and cash.

A 10% ETH move shifts that position’s value by over $900 million, directly influencing Bitmine’s net asset value and investor appetite.

Staking Revenues And Strategy Tied To ETH Price

Bitmine has staked about 2.9 million ETH and expects its MAVAN validator network to lift annualized rewards above $370 million. Because rewards are paid in ETH, the dollar value of that income, and Bitmine’s ability to fund operations, expansion and token purchases, hinges on Ethereum’s market price.

Traders see potential for ETH to fall toward the $1,000–$1,200 zone before a longer-term rebound. Management, however, points to a history of sharp “V-shaped” recoveries after past 50%-plus drawdowns as evidence that today’s weakness could ultimately enhance long-term upside for BMNR’s Ethereum-heavy balance sheet.

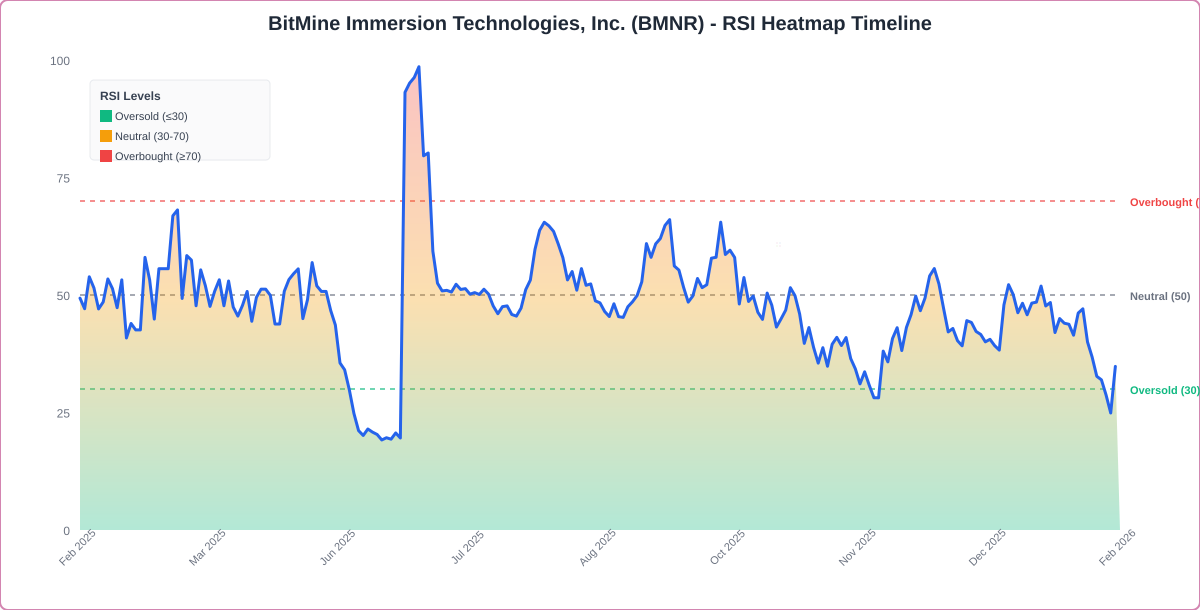

BMNR Technical Analysis

The stock is currently trading 24.9% below its 20-day simple moving average (SMA) and 47.6% below its 100-day SMA, indicating a bearish trend in the short to medium term. Shares have increased 201.88% over the past 12 months and are currently positioned closer to their 52-week lows than highs.

The RSI is at 35.95, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $30.00

- Key Support: $15.00

BMNR Shares Start The Week Flat

BMNR Price Action: BitMine Immersion shares were marginally higher by 1.81% at $20.85 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments