PDD Holdings Inc. (NASDAQ:PDD), the parent company of e-commerce platforms Pinduoduo and Temu and a rival of Amazon.com Inc. (NASDAQ:AMZN), has emerged as a significant value play in early 2026.

Value Score Surges Amid Price Pullback

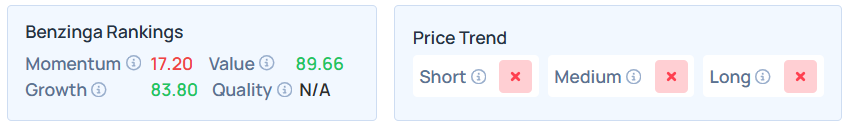

According to recent Benzinga Edge Stock Rankings, the company’s value score has surged to 89.66, placing it in the top 10% of stocks globally based on its relative worth.

This jump to the 90th percentile comes as the stock faces a challenging start to the year, currently trading down approximately 9.09% year-to-date.

The proprietary value metric is a percentile-ranked composite that evaluates a stock’s price against fundamental measures like assets, earnings, and sales. PDD’s score of 89.66 indicates that the market price is low relative to its underlying financial strength.

While the stock price has retreated to roughly $105.23 as of Feb. 6, the underlying fundamentals remain robust. A growth score of 83.80 reflects consistent expansion in revenue and earnings, even as short-term momentum has cooled to a score of 17.20.

PDD maintains a weaker price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

” class=”wp-image-1299607″ srcset=”https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1.png 847w,https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1-300×45.png 300w,https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1-768×116.png 768w” sizes=”(max-width: 847px) 100vw, 847px”>

” class=”wp-image-1299607″ srcset=”https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1.png 847w,https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1-300×45.png 300w,https://editorial-assets.benzinga.com/wp-content/uploads/2026/02/09055016/PDD-EDGE-FEB-9-1-768×116.png 768w” sizes=”(max-width: 847px) 100vw, 847px”>Navigating Regulatory And Competitive Headwinds

The recent 9% YTD slide is largely attributed to external pressures. In late January, Texas Governor Greg Abbott imposed a ban on state employees using PDD’s international platform, Temu, citing data privacy concerns.

Simultaneously, the company has faced a fine of 100,000 yuan from Chinese tax authorities and an expanded government probe into its Shanghai headquarters over alleged misconduct.

Despite these hurdles, PDD continues to be a formidable Amazon rival. The company’s unique social commerce model and “team purchase” strategy have allowed it to maintain strong margins while expanding into over 80 countries.

PDD Underperforms In 2026

Shares of PDD have declined by 9.09% year-to-date, while the Nasdaq Composite has tumbled 0.88% in the same period. It was also down 6.91% over the last six months but up 9.55% over the year.

On Friday, the stock closed 3.65% higher at $105.23 per share, and it was up 0.067% in premarket on Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments