Inflation anxiety among U.S. consumers just hit its lowest point of President Donald Trump‘s second term.

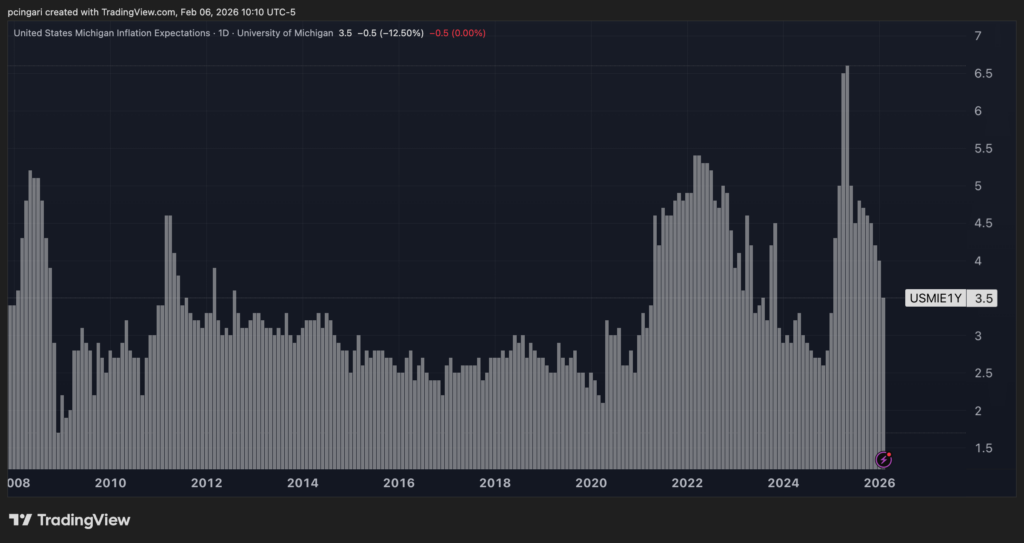

The University of Michigan’s preliminary February survey showed the year‑ahead inflation expectations gauge at 3.5%, down from 4% in January.

• Vanguard S&P 500 ETF shares are advancing steadily. Why is VOO stock trading higher?

This reading is the lowest recorded since January 2025, the month that marked the formal start of Trump’s second term.

Though still above levels seen in 2024, the drop suggests consumers are beginning to temper their inflation outlook.

Long‑run inflation expectations, which look out five years, crept up slightly to 3.4% from 3.3% in January. Those figures remain above the 2.8%–3.2% range seen in 2024 and higher than the sub‑2.8% readings typical in 2019 and 2020.

The overall Michigan consumer sentiment index rose to 57.3 in preliminary February results, ahead of the consensus expectation of 55. This marks the third consecutive monthly increase and represents the highest sentiment reading since August 2025.

The subindex for Current Conditions jumped to 58.3, up sharply from 55.4, beating expectations. In contrast, the subindex for Consumer Expectations dipped slightly to 56.6, down from 57.0.

Chart: Year-Ahead Inflation Expectations Drop To 3.5%, Lowest Since January 2025

Sentiment Up But Still Weak

Joanne Hsu, director of the University of Michigan Surveys of Consumers, said consumer sentiment was “essentially unchanged” with a less than one point increase from last month, and remains “about 20% below January 2025.”

Hsu said the recent rise in sentiment was driven largely by consumers holding the largest stock portfolios, while sentiment stayed “stagnant and remained at dismal levels” for those without equity holdings.

She highlighted that gains in current personal finances and in durable-goods buying conditions were offset by a slight decline in expectations for long‑run business conditions.

Hsu also noted persistent worries about finances and jobs, saying concerns about erosion of personal finances from high prices and an elevated risk of job loss “continue to be widespread.”

Inflation Expectations: Why It Matters

Year‑ahead inflation expectations reflect how much consumers think prices will rise over the next 12 months. This measure is closely watched by economists and policymakers because it can influence wage demands, spending behavior and even Federal Reserve decisions.

The drop to 3.5% suggests that consumers are less anxious about rising prices, even though expectations remain above pre‑pandemic norms.

Markets currently expect the Federal Reserve to cut interest rates twice before year-end, according to the CME FedWatch Tool.

Market Reactions

U.S. stocks attempted a rebound Friday after three straight sessions of losses, as a tech-led sell-off driven by software stocks eased.

The S&P 500 — tracked by the Vanguard S&P 500 ETF Trust (NYSE:VOO) — rose 1.26%. Meanwhile, the blue-chip index tracked by the SPDR Dow Jones Industrial Average ETF (NYSE:DIA) rallied to fresh record highs.

Notably, the Dow Jones has outperformed the tech-heavy Invesco QQQ Trust (NASDAQ:QQQ) in each of the last seven sessions — the longest streak since 2022.

Photo: Shutterstock

Recent Comments