Equifax Inc (NYSE:EFX) reported better-than-expected fourth-quarter financial results on Wednesday.

Equifax posted adjusted EPS of $2.09, beating market estimates of $2.05. The company’s quarterly sales came in at $1.551 billion versus expectations of $1.527 billion.

Equifax said it sees FY2026 adjusted EPS of $8.30-$8.70, versus market estimates of $8.74. The company sees sales of $6.660 billion to $6.780 billion, versus estimates of $6.585 billion.

“Equifax delivered strong fourth quarter revenue of $1.551 billion, up 9% on both a reported and local currency basis, that was $30 million above the midpoint of our October guidance. This was led by strong 20% U.S. Mortgage revenue growth, strong Workforce Solutions Government revenue growth, and continued momentum in New Product Innovation with a Vitality Index of 17% despite headwinds from the U.S. Mortgage and Hiring markets,” said Mark W. Begor, Equifax Chief Executive Officer.

Equifax shares gained 2.4% to $185.29 in pre-market trading.

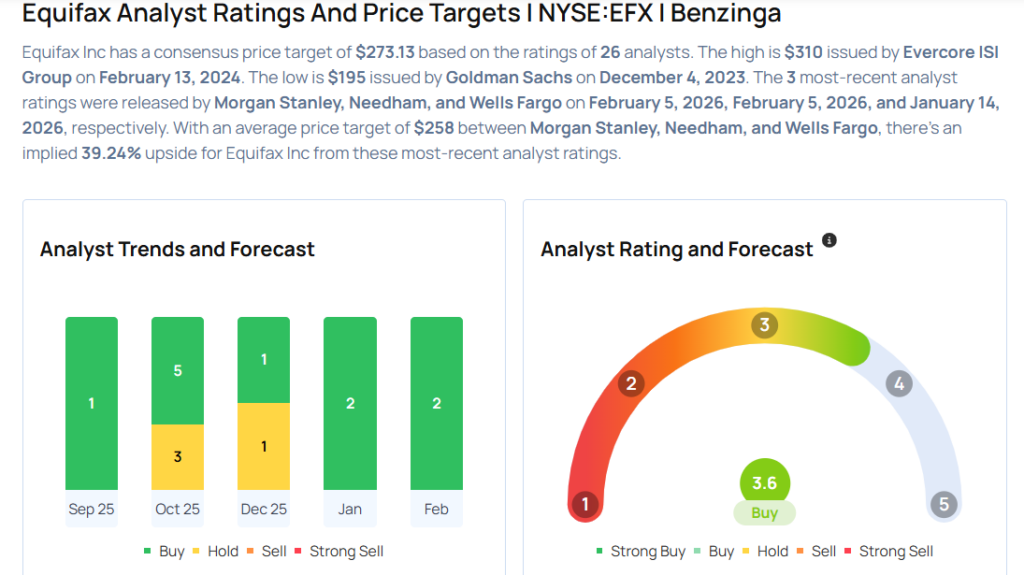

These analysts made changes to their price targets on Equifax following earnings announcement.

- Needham analyst Kyle Peterson maintained Equifax with a Buy and lowered the price target from $295 to $265.

- Morgan Stanley analyst Toni Kaplan maintained the stock with an Overweight rating and cut the price target from $269 to $244.

Considering buying EFX stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments