The Equal Employment Opportunity Commission (EEOC) has sued Nike Inc. (NYSE:NKE) in a Missouri federal court on Wednesday, seeking to force the company to turn over information tied to alleged discrimination against white employees under its Diversity, Equity, and Inclusion (DEI) initiatives.

The agency is asking for details on Nike’s layoff criteria, its use of race and ethnicity data, and programs that allegedly limited mentoring, leadership, or career development opportunities based on race.

In 2022, Nike outlined a plan to build a more diverse workforce, linking part of executive pay to diversity goals, including increasing the share of women in leadership roles, reaching 30% racial minority representation at the director level and above, and lifting racial minority representation in its U.S. workforce to 35%.

Layoffs, Margins And Mounting Pressure

This investigation comes on the heels of a series of significant events for Nike. In January, the company announced layoffs of over 700 U.S. distribution jobs as part of its automation push to enhance profitability. Most of the layoffs will hit distribution center roles in Tennessee and Mississippi, home to Nike’s largest warehouse operations. The cuts, announced by the sneaker giant, come on top of the roughly 1,000 corporate job cuts it revealed last summer.

Benzinga has reached out to Nike for a comment.

This move followed a cautious tone struck by Nike during its earnings conference call in December, amid a softer near-term outlook and rising margin pressures.

Nike Direct sales fell 8% to $4.6 billion as the company rebalanced its marketplace. CFO Matt Friend guided for low single-digit revenue declines in the third quarter and a 175–225 basis point drop in gross margin, while warning that reciprocal tariffs could create a $1.5 billion annualized headwind and compress margins by over 300 basis points, with mitigation efforts taking time.

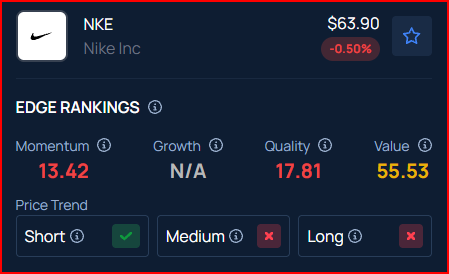

Benzinga’s Edge Rankings place Nike in the 18th percentile for quality and the 55th percentile for value, reflecting its average performance in both areas. Benzinga’s screener allows you to compare Nike performance with its peers.

Price Action: Over the past year, Nike stock declined 16.29%, as per data from Benzinga Pro. On Wednesday, the stock climbed 5.40% to close at $64.22.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Roman Zaiets / Shutterstock.com

Recent Comments