On Wednesday, Verizon Communications Inc. (NYSE:VZ) filed a federal lawsuit accusing T-Mobile U.S. (NASDAQ:TMUS) of misleading consumers with exaggerated claims that customers can save more than $1,000 a year by switching wireless carriers.

Verizon Accuses T-Mobile Of False Advertising

Verizon sued T-Mobile in Manhattan federal court, alleging its largest rival engaged in false advertising that caused irreparable harm by overstating potential consumer savings, reported Reuters.

According to the complaint, T-Mobile’s marketing campaigns promised annual savings exceeding $1,000, claims Verizon says were exaggerated and, in some cases, inflated by more than 100%.

Claims Previously Flagged By Advertising Watchdog

The lawsuit says T-Mobile continued to promote savings claims that are “substantially identical” to advertising assertions the National Advertising Review Board found unsubstantiated and misleading in 2025 and 2026.

Bundled Services At Center Of Dispute

Verizon said T-Mobile’s ads understate Verizon’s discounts from service packages that include combinations such as Netflix Inc. (NASDAQ:NFLX) with Warner Bros. Discovery’s (NASDAQ:WBD) HBO Max or Walt Disney Co.’s (NYSE:DIS) Hulu bundled with Disney+ and ESPN+.

Verizon Seeks Triple Damages, Injunction

Verizon is seeking unspecified triple damages under the federal Lanham Act for alleged intentional false advertising, along with additional damages under New York’s unfair competition and trade practices laws.

The lawsuit also asks the court to block T-Mobile from running the challenged advertisements.

As of the most recent filings, Verizon reported 146.9 million subscribers, compared with T-Mobile’s 139.9 million. AT&T (NYSE:T) ranked third with 120.1 million subscribers.

Verizon and T-Mobile did not immediately respond to Benzinga’s request for comments.

Lawsuit Follows Strong Verizon Earnings

The legal action comes as Verizon reported fourth-quarter results and issued positive 2026 guidance.

The company posted revenue of $36.40 billion, up 2% year over year, beating analyst expectations. Adjusted earnings per share of $1.09 also topped estimates.

Verizon added 616,000 postpaid phone subscribers during the quarter, its strongest performance since 2019.

T-Mobile is scheduled to report fourth-quarter earnings on Feb. 11.

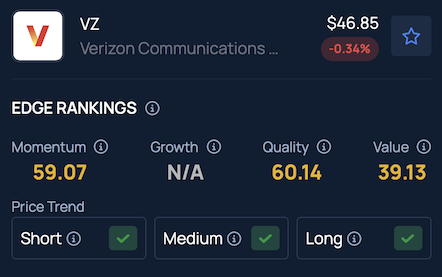

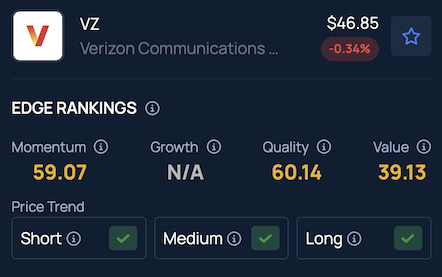

Price Action: Verizon shares gained 1.72% on Wednesday and were down 0.34% in after-hours trading, according to Benzinga Pro.

VZ shows a stronger price trend across the short, medium and long-term horizons, supported by a mid-range Value ranking, according to Benzinga’s Edge Stock Rankings.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: RAMAN SHAUNIA on Shutterstock.com

Recent Comments