As of Feb. 4, 2026, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

SanDisk Corp (NASDAQ:SNDK)

- On Jan. 29, Sandisk reported better-than-expected second-quarter financial results and issued third-quarter guidance above estimates. “This quarter’s performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world’s technology is being recognized,” said David Goeckeler, CEO, Sandisk. The company’s stock gained around 154% over the past month and has a 52-week high of $725.00.

- RSI Value: 89.7

- SNDK Price Action: Shares of SanDisk gained 4.6% to close at $695.51 on Tuesday.

- On Feb. 2, Teradyne reported better-than-expected fourth-quarter financial results and issued first-quarter EPS guidance above estimates. “Our Q4 results were above the high end of our guidance range, fueled by AI-related demand in compute, networking and memory within our Semi Test business. Across all of our business groups – Semi Test, Product Test, and Robotics – we experienced sequential growth, and at the company level we achieved 13% growth in 2025,” said Teradyne CEO, Greg Smith. The company’s stock gained around 29% over the past month and has a 52-week high of $286.00.

- RSI Value: 84.3

- TER Price Action: Shares of Teradyne rose 13.4% to close at $282.98 on Tuesday.

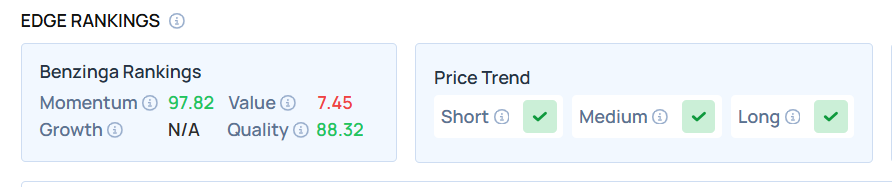

- Edge Stock Ratings: 97.82 Momentum score with Value at 7.45.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Photo via Shutterstock

Recent Comments