Major U.S. indexes finished Monday higher, led by a 1.05% jump in the Dow Jones Industrial Average to 49,407.66. The S&P 500 added 0.5% to 6,976.44, and the Nasdaq climbed 0.56% to 23,592.10.

These are the top stocks that gained the attention of retail traders and investors through the day.

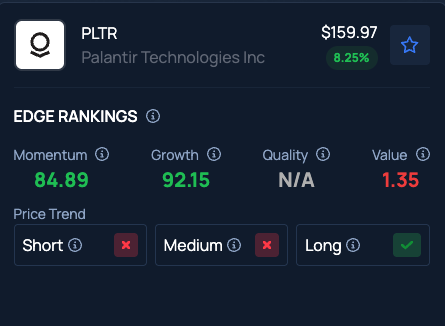

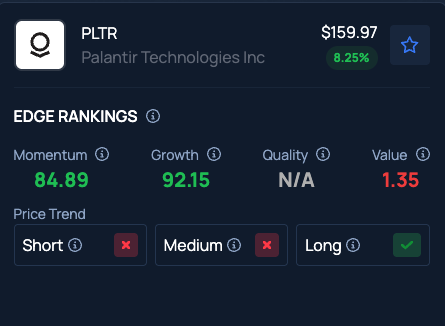

Palantir Technologies Inc. (NASDAQ:PLTR)

Palantir’s stock rose by 0.81%, closing at $147.78. The stock hit an intraday high of $151.40 and a low of $146.65, with a 52-week range of $66.12 to $207.52. The stock gained 6.97% to $158.08 in after-hours trading.

Palantir Technologies reported fourth-quarter revenue of $1.41 billion, beating estimates of $1.33 billion, while adjusted EPS came in at 25 cents versus expectations of 23 cents. Revenue rose 70% year over year, driven by 93% growth in U.S. revenue, including a 137% jump in U.S. commercial sales to $507 million, as customer count increased 34%.

The company generated $791 million in adjusted free cash flow and issued strong guidance, forecasting first-quarter revenue of up to $1.536 billion and full-year 2026 revenue of as much as $7.20 billion.

Teradyne, Inc. (NASDAQ:TER)

Teradyne’s shares soared by 3.52%, closing at $249.53. The stock reached an intraday high of $254.68 and a low of $240.67, with a 52-week range of $65.77 to $255.20. The stock soared 19.42% to $298 in extended trading.

Teradyne reported fourth-quarter adjusted earnings of $1.80 per share, beating estimates of $1.35, while revenue came in at $1.08 billion, ahead of expectations for $971.09 million. Revenue increased from $752.88 million a year earlier, driven by AI-related demand across compute, networking and memory within its semiconductor test business.

The company said all business segments posted sequential growth and projected strong momentum into 2026, supported by AI-driven compute demand. For the first quarter, Teradyne forecast adjusted EPS of $1.89 to $2.25 and revenue of $1.15 billion to $1.25 billion, well above Street estimates.

Caterpillar Inc. (NYSE:CAT)

Caterpillar’s stock climbed 5.12%, closing at $690.91. It reached a new 52-week high of $691.38, with a low of $657.43.

Caterpillar reported results last week, saying higher tariffs weighed on manufacturing costs and margins, with the company citing tariff impacts as a key factor behind weaker operating profit despite strong sales growth. The machinery maker still posted record quarterly and full-year revenue, but said tariff-related costs and restructuring charges pressured profitability in the fourth quarter.

NXP Semiconductors (NASDAQ:NXPI)

NXP’s stock rose 2.18%, closing at $231.08. The stock’s intraday high was $234.09, with a low of $224.45, and a 52-week range of $148.09 to $255.41. The stock fell 5.2% to $219 in the after-hours trading.

NXP Semiconductors reported fourth-quarter earnings of $3.35 per share, beating estimates of $3.16 by 6%.

Revenue increased by $224 million from the same period last year, marking year-over-year growth.

The Walt Disney Company (NYSE:DIS)

Disney’s stock fell by 7.40%, closing at $104.45. The stock’s intraday high was $108.61, with a low of $103.75, and a 52-week range of $80.10 to $124.69.

Walt Disney’s board was reported to be moving toward naming theme-park chief Josh D’Amaro as the company’s next CEO, potentially succeeding Bob Iger before his contract ends on December 31.

Iger had signaled plans to step back from day-to-day management and was expected to remain for several months to support the transition, as Disney prepared to report fiscal first-quarter earnings and target a CEO announcement in early 2026.

Benzinga Edge Stock Rankings show that Palantir stock ranks in the 1st percentile for Value and the 84th percentile for Momentum.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: Beautyimage on Shutterstock.com

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Recent Comments