Caterpillar Inc. (NYSE:CAT) reported upbeat earnings for the fourth quarter on Thursday.

For the fourth quarter of 2025, sales and revenues were $19.133 billion, up 18% from $16.215 billion in the prior-year period. Adjusted profit per share was $5.16, beating a $4.66 estimate, while revenue exceeded a $17.851 billion estimate.

Fourth-quarter profit per diluted share (GAAP) was $5.12, compared with $5.78 a year earlier. Operating profit was $2.660 billion, down 9%, and operating profit margin was 13.9% versus 18.0% in the fourth quarter of 2024.

Caterpillar CEO Joe Creed said, “With a record backlog, we enter the new year with strong momentum and a continued focus on delivering long-term value for our customers and shareholders.”

Caterpillar shares fell 0.9% to trade at $658.73 on Friday.

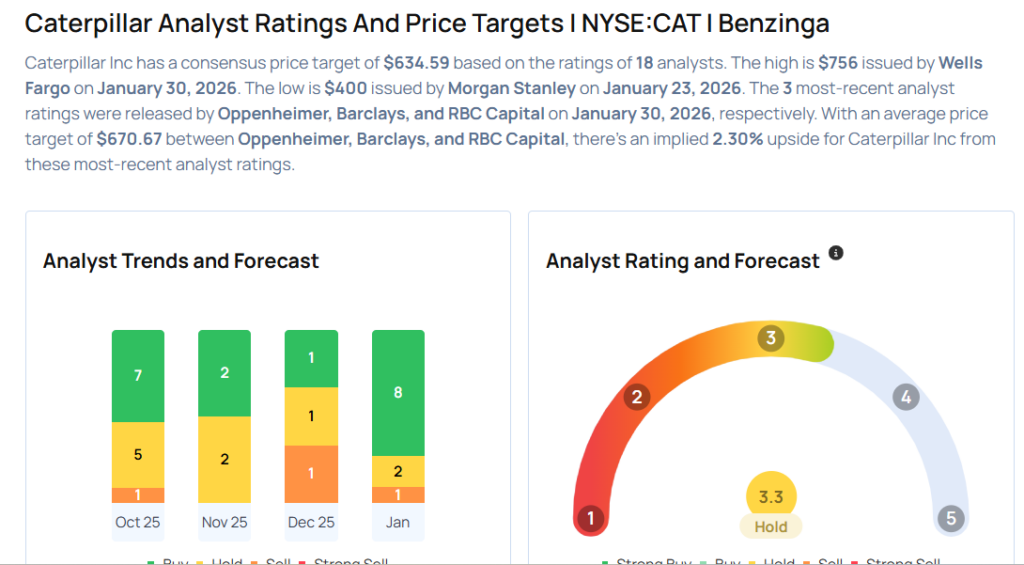

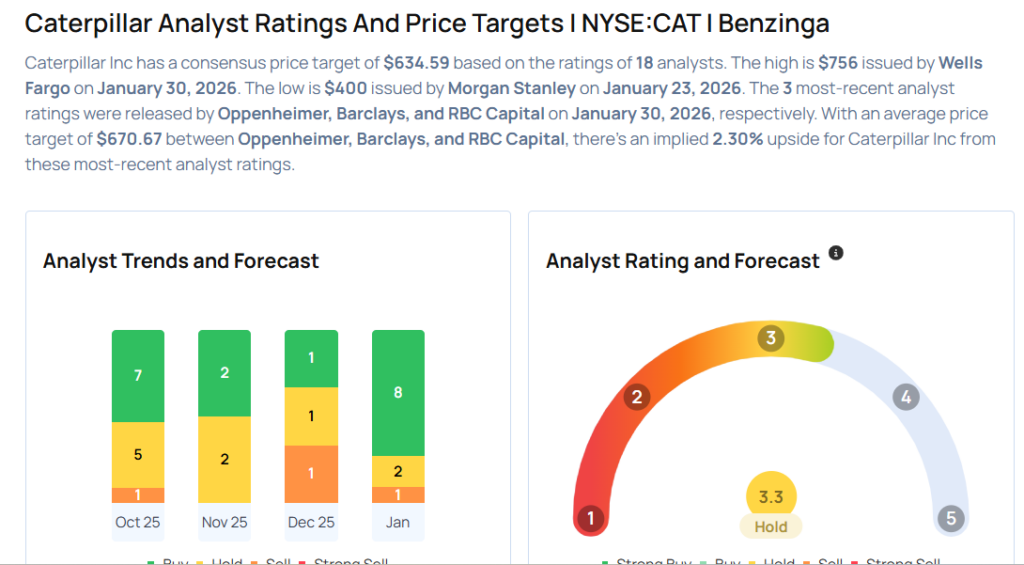

These analysts made changes to their price targets on Caterpillar following earnings announcement.

- B of A Securities analyst Michael Feniger maintained Caterpillar with a Buy and raised the price target from $708 to $735.

- Wells Fargo analyst Jerry Revich maintained the stock with an Overweight rating and raised the price target from $702 to $756.

- RBC Capital analyst Sabahat Khan maintained Caterpillar with a Sector Perform and increased the price target from $587 to $658.

- Barclays analyst Adam Seiden maintained the stock with an Equal-Weight rating and raised the price target from $610 to $625.

- Oppenheimer analyst Kristen Owen maintained Caterpillar with an Outperform rating and raised the price target from $700 to $729.

Considering buying CAT stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments